Rich people to pay more tax, mid-income less

Shawdesh desk:

The wealthy people in the country are likely to levied more tax in the upcoming national budget.

This is a part of the government’s hunt for more revenues while providing some comfort to the middle-income people raising the tax-free income limit amid inflation.

Official sources said the highest rate of income tax may be increased to 30 percent from the current 25 percent in the budget for the upcoming fiscal year 2023-24.

The proposed budget will be placed at the national parliament on June 1.

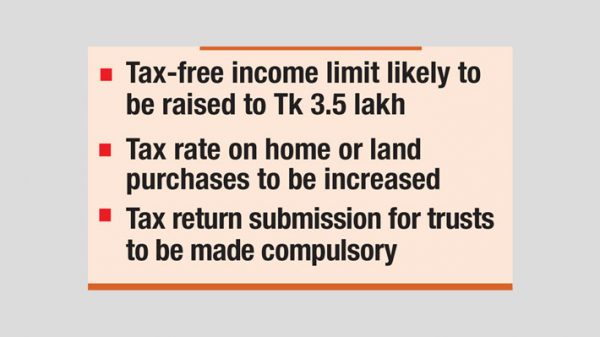

The tax-free income limit, on the other hand, is likely to be increased to Tk 3.5 lakh from existing Tk 3 lakh in consideration of high living cost triggered by rising inflation.

The National Board of Revenue (NBR) is also going to take steps to fend off tax dodging in income from trust funds, official sources added.

The government also mulls over imposing a minimum Tk 2,000 tax on individuals who will file tax returns even if they do not have taxable income.

However, a number of economic analysts do not subscribe to the move saying that it would burden low-income people and contradict the concept of tax-free income thresholds.

Recently, the finance minister, National Board of Revenue (NBR) chairman and a number of budget related officials placed the tax proposals before Prime Minister Sheikh Hasina, finance ministry and NBR officials said.

In the light of the Premier’s suggestions, some changes will be made to the finance bill that the finance minister will place at the national parliament on June 01, the sources said.

At present, the people with up to Tk 3 lakh yearly income do not have to pay any tax on their incomes.

If the income is above that level but within Tk 4 lakh, the income tax rate will be 5 percent.

However, the tax rate will be 10 percent if the income is from above Tk 4 lakh to Tk 7 lakh, 15 percent for up to Tk 11 lakh, 20 percent for up to Tk 16 lakh and 25 percent for more.

The wealthy people fall under the 25 percent tax segment. Prior to the coronavirus pandemic, the tax rate was 30 percent. Changes may come in other segments as well.

Land registration costs may also rise. In Dhaka and Chattagram cities, the buyers have to pay 4 percent tax over the total price of land or home, which may be raised to 5 percent.

The tax can also be raised from existing 3 percent to 4 percent in case of home or land purchase in other areas.

NBR set a target to collect Tk 1,210.94 billion in the outgoing FY 2022-23, of which, it managed to collect Tk 701.58 billion in the first nine months.

In the FY 2021-21, the NBR collected Tk 845.22 billion as income tax.

“It is necessary to return the highest tax rate to 30 percent because the tax rate was cut taking into account the coronavirus pandemic situation,” said Prof. Mustafizur Rahman, the Distinguished Fellow of Centre for Policy Dialogue (CPD).

He said some recent studies showed that income inequality increased in the country in recent times.

“In these circumstances, more spending should be made on social security schemes by collecting more money from the wealthier segment of the society,” he suggested.

Besides, the NBR is advancing with a plan to mobilise more revenues from the income coming in the form of trust funds.

In this regard, it will keep a provision in the budget for return submission and scrutiny to ensure bank account opening and keep it running against income from trusts.

According to the Income Tax Ordinance 1984, trust is a taxable entity, but the trustees do not pay income tax or submit income returns regularly to comply with the law.

Some companies form trust funds with the objective of concealing their income and dodging tax, creating a ground for tax evasion through not submitting returns.

In some cases, the trust money is being used for terror financing and money laundering in absence of particular agencies for monitoring regular financial transactions of the trusts and such types of institutions, official sources said.

With the provision for compulsory tax return submission for trusts, the government thinks that it will be able to enhance revenues alongside preventing tax evasion.

The budget is being placed at a time when the government has to comply with the IMF loan while putting a cushion for the general people amid huge pressure of inflation caused by the Russia-Ukraine war that shot up food and energy prices all over the world.

Leave a Reply