National Budget Speech 2021-2022

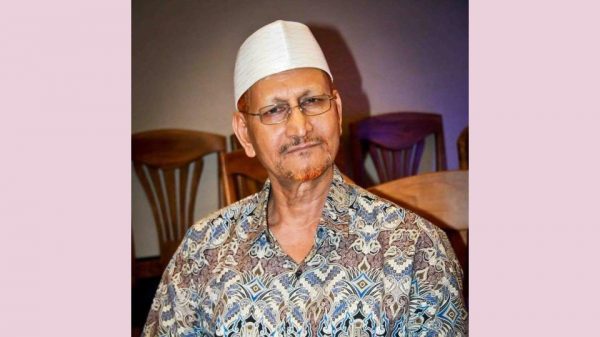

A H M Mustafa Kamal FCA, MP

Minister Ministry of Finance

Government of the People’s Republic of Bangladesh

20 Jaisthya 1428

03 June 2021

Table of Content

| Topic | Page |

| Chapter I

Tribute |

|

| Profound Respect and Gratitude to the Father of the Nation Bangabandhu Sheikh Mujibur Rahman and all the martyrs in

the independence war |

1-2 |

| Chapter II

Birth Centenary of Sheikh Mujib and the Golden Jubilee of Independence |

|

| Celebration of the Birth Centenary of Bangabandhu Sheikh Mujib and the Golden Jubilee of Independence; the position

of Bangladesh in the field of economy |

3-14 |

| Chapter III

Graduating to the status of a developing country and the journey onward |

|

| Bangladesh becomes eligibile for graduation into a developing country; Post-graduation challenges as a developing country; Strategies to deal with the post-

graduation situation |

15-20 |

| Chapter IV

COVID-19 Pandemic and Economic Recovery |

|

| The impact of COVID-19 pandemic in Bangladesh; implementation of fiscal packages for economic recovery from COVID-19 impact; Assistance from Development

Partners to combat COVID-19 impact. |

21-25 |

| Chapter V

Perspective and Background: Global Economy and Bangladesh |

|

| Global economic forecasts amid the COVID-19 pandemic;

Current economic position and the image of Bangladesh |

26-28 |

| Topic | Page |

| Chapter VI

The Supplementary Budget |

|

| The Supplementary Budget for the current FY 2020-2021; Revised Revenue Income and Revised Expenditure; Revised

Budget Deficit and its Financing |

29-30 |

| Chapter VII

Proposed Budget Structure of FY 2021-2022 |

|

| Proposed Budget Structure of FY2021-2022; Reveune Colleciton; Overall Expenditure Structure | 31-33 |

| Chapter VIII

Sectoral Strategies, Action Plans and Resource Mobilization |

|

| Medium-Term Policy Strategy: implementation of 8th Five Year Plan and priority of Bangladesh; Health and tackling the pandemic; Education: Primary and Mass Education, Secondary Education, Madrasha and Technical Education; Agriculture Sector: Fisheries and Livestock, Food Security; Employment Generation; Poverty Reduction and Social Safety Net Programmes; Local Government and Rural Development; Industrialization and Trade; Physical Infrastructure: Power and Energy; Communication infrastructure; Digital Bangladesh; Women Empowerment and Children Welfare; Climate change and Environment protection; Sports, Culture and Religion; Planned

Urbanization and Housing |

34-98 |

| Chapter IX

Reform and Good Governance |

|

| Accelerating Structural Transformation of the Economy; Improving Investment Climate; Automation of Land Management; Implementation of E-Judiciary; Fighting Corruption; Reforms in Financial Sector; Public Financial

Management; Improved public service |

99-108 |

| Topic | Page |

| Chapter X

Revenue Collection Activities |

|

| Achievement in Revenue Collection; Digitisations of Revenue Management; Modernazations of Customs;

Application of Information Technology |

109-

112 |

| Chapter XI

Income Tax, Value Added Tax and Import-Export Duty |

|

| Direct Tax: Income Tax, Tax rate and Tax free income ceiling; Value Added Tax (VAT); Import-Export Duty-Taxes: Agriculture Sector, Health Sector, Industry Sector, ICT Sector, Automobile Sector; Amendment of Customs Act,

Amendment in First Schedule of Customs Act |

113-

139 |

| Chapter XII

Progress in Implementation of Commitments Made in the Budget |

|

| Progress in implementation of the commitments made to the nation in the Budget FY 2020-2021 | 140-

143 |

| Conclusion | |

| Conclusion | 144-

145 |

| Annexure-A | |

| Table 1: Number of Beneficiaries under 23 Stimulus Packages Announced by the Government to Address the COVID-19

Fallout |

149 |

| Table 2: State of Socio-economic Progress | 151 |

| Table 3: Progress in the Past Decade | 151 |

| Table 4: Supplementary Budget for FY2020-21 | 152 |

| Table 5: Proposed Budget Structure for FY 2021-22 | 153 |

| Table 6: Annual Development Programme (Sectoral

Allocation) for FY 2021-2022 |

154 |

| Table 7: Sectoral Allocation in Budget | 155 |

| Table 8: Ministry/Division-wise Budget Allocations | 157 |

| Topic | Page | |

| Annexure-B

(List of table of import-export duty) |

||

| Table 1: Agriculture Sector | 161 | |

| Table 2: Health Sector | 163 | |

| Table 3: Industry Sector | 165 | |

| Table 4: Tariff Rationalization | 172 | |

| i. | Increase/decrease in duty and taxes | 172 |

| a) Reduction in CD | 172 | |

| b) Increase in CD | 173 | |

| c) Reduction in specific duty | 173 | |

| d) Increase/decrease in regulatory duty | 174 | |

| e) Increase/decrease/imposition/withdrawal of

Supplementary duty |

174 | |

| ii. | Split/merge/creation of H.S. Codes and changes

made in description against some H.S. code |

175 |

| a) H.S. Codes against which description has

been changed |

175 | |

| b) H.S. Codes that have been split | 176 | |

| c) H.S. Codes which has been created | 177 | |

| d) List of H.S. Code that has been Merged | 179 | |

| e) List of H.S. Codes that has been created | 180 | |

| f) Correction of Heading 87.04 | 180 | |

| g) Correction of Heading 87.11 | 181 | |

| h) List of H.S. Codes that has been abolished | 182 | |

National Budget of Bangladesh 2021-2022 Chapter One

Tribute

[In the name of Allah, The Most Gracious and The Most Merciful]

[Blessed is He in whose hand is dominion, and He is over all things competent]

Madam Speaker

- I, A H M Mustafa Kamal, Finance Minister, seek your kind permission to place before this august House the Supplementary Budget for the fiscal year 2020-2021 and the proposed budget for the fiscal year 2021-2022.

Madam Speaker

- I begin my speech with profound respect and gratitude to the Father of the Nation Bangabandhu Sheikh Mujibur Rahman, the greatest son of the Bengalis, the dreamer of Golden Bengal, the greatest Bengali of all times, who instilled the desire of freedom in the minds of the Bengalis. We remember him as an immortal hero of the soil, who has been at eternal rest, under the shade of Hijal-Tamal trees at Tungipara, Gopalganj, whose name is emblemed in the flag of our victory; every letter of whose name represents our freedom, who broke thousand shackles, stood tall against all odds and resolutely prsued his ideals.

- I remember with deep respect all the martyrs, including Shaheed Bangamata who sacrificed their lives in the fateful night of August 15, 1975. I am also remembering Bangabandhu’s most trusted comrades, four national leaders who embraced martyrdom in the central jail. With profound love and respect, I remember all those valiant heroes who dedicated their lives for the country during the movements starting from our self-determination to the independence war, for whose supreme sacrifice we are free today. I also remember those thirty lakh martyred freedom fighters and two lakh women who were brutally persecuted during the liberation war. I am remembering those whom we have lost prematurely during the COVID-19 pandemic. I pray to the Almighty for the salvation of all the departed souls.

Chapter Two

Bangladesh’s Position in the Field of Economy during the Birth Centenary of Sheikh Mujib and the Golden Jubilee of Independence

Madam Speaker

- It was 8.00 pm on March 17, 1920, Wednesday. The sound of Azan, the waves of Madhumati river, the chirping of birds and the song of spring could be heard all around. It is at this auspicious moment, Sheikh Mujibur Rahman, was born in the village of Tungipara in Gopalganj with his parents Sheikh Lutfur Rahman and Sheikh Sayera Begum. It is this man who materialised our thousand years of pursuit and emerged as the savior of liberation of humanity. He came to be known to as ‘Khoka’ (dear boy). His courage inspired millions of people of the Bengali nation, who in response to his clarion call came forward and won the war for liberation and created a history. The people of Bengal, therefore, conferred on him the title of Bangabandhu on 23 February 1969. Defying all odds he was at the forefront of the student movement, movement for fundamental rights of the people, the language movement, the six-point movement, the mass upsurge, and spent 4,682 days in jail. He had to endure inhuman torture and oppression, and gifted the long-subdued, oppressed and deprived nation an address, wrapped in red-green flag, an independent and sovereign Bangladesh, the name of a country which he himself had given. Thus he became the Father of the Nation, from Bangabandhu Sheikh Mujib.

Madam Speaker

- In the centenary of his birth, we as a nation are moving forward, following his footprint and the roadmap he laid down for our economic emancipation. The nation is celebrating his birth centenary, the Mujib Borsho. Bangabandhu and Bangladesh are inseparable. This year also marks the fiftieth anniversary of Bangladesh’s independence – the golden jubilee of our glorious independence being celebrated at home and abroad. The year is like the confluence of two great streams – an estuary of time. In this great estuary, another feather is added: we are graduating from the status of a Least Development Country to a Developing Country, a major achievement in the nation’s life. This year, in which we have earned three important milestones, will be considered, in the coming days, as the golden year in our nation’s history.

Madam Speaker

- Bangabandhu is not just a name, Bangabandhu is an ever-vigilant history. He represents an immeasurable pride – the most illumined treasure of our nationhood, – an immortal name embedded in our existence. A liberal, noble-hearted man as he was, he had always been vocal in upholding the just cause, truth, people’s welfare and self-determination. Not even a iota of narrowness, orthodoxy and communalism could touch him ever. At every stages of life, he dreamt of total liberation of the Bengalis. He had an immeasurable love for Bengalis and Bangladesh which he dreamt of and for which he spent much of his youthful times in jails, and sang the triumph of the Bengalis at the gallows. It is possible to measure the depth of sea or ocean, but his love for Bangladesh and Bengalis was immeasurable. As Bangabandhu said: “My greatest strength is that I love the people of my country; my greatest weakness is that I love them too much.” He also said: “I am in need of the love of seven crore Bengalis. I can lose everything, but I cannot lose the love of the people of Bangladesh.”

Madam Speaker

- We had planned for a countrywide colorful celebration of the birth centenary of the Father of the Nation Bangabandhu Sheikh Mujibur Rahman and the golden jubilee of our independence. However, due to sudden outbreak of COVID-19, it was celebrated in a limited scale throughout the year. Besides, at the national level, a ten-day program was organised in a limited scale by maintaining health protocols from 17 March to 26 March with the main theme ‘Mujib Chirantan’ from March 16 to March 26 in compliance with health safety rules. This celebration was not a mere formality, rather it was aimed at infusing new life-force in our national life, moving one step closure, imbued with new spirit, to realise the dream of a golden Bengal envisioned by the Father of the Nation.

Madam Speaker

- Let me now recount the early days of the Bangladesh economy and also the history how under the leadership of Hon’ble Prime Minister Sheikh Hasina, the heir to the Father of the Nation Bangabandhu Sheikh Mujibur Rahman, Bangladesh has transformed itself from a bottomless basket case to a role model of development. Immediately after our independence, achieved through unprecedented nine months long bloody war, we did not have any infrastructure or resources. The entire Bangladesh was in ruins, there were only wails all around. Bangladesh was the poorest country in South Asia, of course poorer than India and Pakistan. Not only in South Asia, Bangladesh was one of the top-ten poorest countries in the world. Around 88 percent of the population in Bangladesh was poor and the dependence on foreign aid was also 88 percent. After returning home from the Pakistani jail on 10 January 1972, the Father of the Nation Bangabandhu Shiekh Mujibur Rahman embarked on the most difficult task of rebuilding the country from a scratch. Bangabandhu said: “I dreamt of independence, today we have achieved it. I dreamt of a Golden Bengal, I want to die seeing a Golden Bengal.” He also said: “We all now have to work hardest to rebuild this devastated country.” Many feared about the future of the country. Eminent economist Austin Robinson in his book Economic Prospectus of Bangladesh expressed doubts about the survival of Bangladesh and compared the future of Bangladesh with Malthusian stagnation resulting in famine and death as population growth was higher than economic growth. Henry Kissinger, the then US Security Adviser, compared Bangladesh to a bottomless basket and hinted at an uncertain future of the country. However Bangabandhu firmly said to everyone: “Bangladesh has come, Bangladesh will remain.” No one could suppress indomitable fearless Bangabandhu and the Bengali nation. Finance Minister Tajuddin Ahmed presented the first budget of Bangabandhu government amounting to Tk 719 crore. Keeping in view of the country’s development, 64 percent of the budget was allocated in the development budget. Under the strong leadership of Bangabandhu, Bangladesh achieved 2.5 percent GDP growth in the first fiscal year of independence, i.e. in 1972-1973, with the GDP increasing to Tk 4,985 crore and the per capita national income standing at US$ 94.

- Considering the importance of planned economic activities, Bangabandhu formulated the first five-year plan (1973-1978). In the first five-year plan, poverty reduction was determined as the priority goal. Then, emphasis was laid on rebuilding programmes and increased production. The target was set at an average GDP growth of 5.5 percent per annum. Several targets such as controlling daily essential commodity prices within people’s reach, increasing per capita income by at least 2.5 percent per annum, reducing dependence on foreign aid, controlling population growth, increasing development expenditure, etc. were set. Detailed strategies for achieving each goal were also clearly described. The country was moving forward as planned. In the second year of the plan, in 1974-1975, the highest GDP growth of 9.59 percent was achieved against the target of 5.5 percent. If we had not lost Bangabandhu on the fateful night of August 15, 1975 and could continue to grow at the same pace, our GDP would have surpassed US$ 300 billion in 35 years and our GDP on the golden jubilee of independence would have stood at US$ 1.2 trillion, similar to the GDP of a developed country. However, we are ill- fated. Some misguided individuals, who opposed the spirit of independence, did not let the Father of our Nation to seize this opportunity.

Madam Speaker

- After August 15, 1975, Bangladesh and its economy sank into a spell of deep darkness – the process of building a happy and prosperous golden Bengal initiated by the Father of the Nation came to a halt. Hon’ble Prime Minister Sheikh Hasina, a legend of this generation and transformer of a modern Bangladesh, is the blood heir to Bangabandhu, the torch- bearer of building a Golden Bengal. On 17 May 1981, she returned home after six years in exile. Defying all odds and risking life, she took the arduous task of restoring democracy and human rights. After enduring long 15 years of struggle and oppression, she formed a government in 1996 with people’s mandate and focused on changing the destiny of the people and opened a new horizon of opportunities in 1996. During 1996- 2001, the average GDP growth was 5.5 percent. The average CPI inflation was 4.4 percent. She built a solid economic foundation by re-establishing the ideals of independence and the spirit of the Liberation War at all levels, institutionalizing democracy, repealing the infamous Indemnity Ordinance and establishing rule of law by instituting the trial of the cases for killing of the Father of the Nation and the jail murders, preserving human rights and peace, signing the Hill Tracts Peace Treaty, signing of the Ganges Water Sharing Treaty, unprecedented development in the agriculture sector, cancellation of the Vested Property Act, recognition of International Mother Language Day, improvement in the defense system, tackling the devastating floods of 1998, women’s empowerment, child development, reducing poverty rate to 44.3 percent, micro-credit programme, providing homes to the homeless through the Housing Fund, allowances for valiant freedom fighters, formulation of new health policy to ensure health for all – development of nationwide hospital system and establishment of community clinics, raising the average life expectancy to 63 years, introduction of old age allowances for the first time in the history of the country, introduction of distressed women allowances, establishment of the Disability Foundation, introduction of ‘one house one firm programme’, setting up of the Employment Bank, removing longstanding economic indiscipline, adoption of timely and modern education policy for the development of education, introducing stipend system for female students of secondary schools, improving literacy rate from 44 percent to 65 percent, and measures for the preservation of the environment. However, the momentum of development crumbled again.

Madam Speaker

- After a stagnation of long 8 years, the wheel of fortune of the people of Bangladesh started turning again after the formation of the government under the leadership of Hon’ble Prime Minister Sheikh Hasina in 2009 – they did not have to look back. It was the time to move forward. In the parliamentary elections of 2014 and 2019, the people of this country also gave the opportunity to Bangladesh Awami League for uninterrupted development of the country. Under the strong leadership of the legendary Prime Minister Sheikh Hasina, the icon of modern Bangladesh, the stories of success and development are being written one after another, which even surpass fairy tales. Standing at a vantage point, when the nation is celebrating the golden jubilee of independence, I would like to focus on extra-ordinary successes of our government during the last twelve years. Bangladesh is now at a critical juncture in its development journey. Bangladesh a decade ago and today’s Bangladesh are not the same. Today’s Bangladesh is in the process of transformation. We have passed a golden era in the history of Bangladesh, which is highly acclaimed. After Bangabandhu, Hon’ble Prime Minister Sheikh Hasina has brought Bangladesh to the pinnacle of successs in all areas, including economy and development, social policy, culture, law and order and foreign policy. In the last 12 years, the average growth of GDP was 6.6 percent which was above 7 percent in FY2017-2018, 2017-2018 and 2018-2019 and exceeded 8 percent in FY2018-2019. Price inflation was at a tolerable level. In FY2005-2006, our per capita income was US$ 543, which is now US$ 2,227. At that time, the poverty rate was 41.5 percent. At present, the poverty rate has come down to 20.5 percent. The size of GDP has increased from Tk. 4,82,337 crore to Tk. 28 lakh crore. Foreign exchange reserves stood at just US$ 0.744 billion in FY2005-2006, or less than US$1 billion, which has now crossed over US$44 billion.

- The size of the budget in FY2005-2006 was Tk. 61,000 crore which has now increased ten times in the current fiscal year. The average life expectancy has increased from 59 years in FY2005-2006 to 72.6 years in FY2019-2020. The infant mortality rate has come down from 84 to 28 per thousand and the maternal mortality rate from 370 to 185 per lakh. Allocation for the social security sector was Tk. 2,505 crore in FY2005-

06. Tk. 95,574 crore is allocated in the current fiscal year. Production of granular grains in FY2005-2006 was 1 crore 60 lakh tons. It has now increased to 4 crore 53 lakh 44 thousand metric tons. Power generation capacity has increased from 4,900 MW to 25,227 MW. The beneficiary coverage of electricity has increased from 47 to 99 percent.

- The pace at which Bangladesh achieved economic growth during the last 12 years, created a consistent growth pattern in our development trajectory. Unfortunately, the COVID-19 pandemic hit us hard in March 2020, and it is still raging across the country. The pandemic is not only threatening our healthcare system but also putting our economic advancement in limbo. Given this situation, we are now paying our attention to combat the pandemic by enhancing the capacity of our healthcare system and tackling the economic shocks. Under the strong leadership of Hon’ble Prime Minister Shiekh Hasina, we are trying to continue our economic programmes by laying emphasis on lives and livelihood.

Madam Speaker

- Bangladesh, once one of the ten poorest countries in the world, is now the 41st largest economy in the world. According to the Center for Economic and Business Research (CEBR), a British economic research organisation, Bangladesh will become the 25th largest economy in the world by 2035 if the current trend in economic growth continues. The extraordinary pace of development of Bangladesh has stunned the world today. Bangladesh is now a wonder of the wonders. World leaders, who attended the national programme of Mujib’s birth centenary and golden jubilee of independence, held from 17 to 26 March 2021, have noted the progress of Bangladesh with high admiration.

- Heads of State and Heads of Government from various countries, including the Prime Minister of India Narendra Modi, President of Maldives Ibrahim Mohammed Salih, Prime Minister of Sri Lanka Mahinda Rajapaksa, President of Nepal Vidya Devi Bhandari and Prime Minister of Bhutan Lotte Shering were present on the occasion. Also many sent congratulatory notes and video messages. Included among them are: the UN Secretary General Antonio Guterres, US President Joe Biden, Russian President Vladimir Putin, UK Prime Minister Boris Johnson, Chinese President Xi Jinping, Canadian Prime Minister Justin Trudeau, Cambodian Prime Minister Hun Sen, Pakistani Prime Minister Imran Khan, Indian Congress President Sonia Gandhi, OIC Secretary General Yousef Ahmed al-Othaimeen, Japanese Prime Minister Yoshihide Suga, Pope Francis, South Korean Prime Minister Chung Su-quen, Britain’s Queen Elizabeth II, and Jordan’s King Abdullah al-Hussein.

US President Joe Biden said, “Bangladesh is an example of economic progress and a country of great hope and opportunity.”

The Prime Minister of India Narendra Modi said, “Bangladesh is showing the world its potential. Now is the time to move forward. It can’t be delayed anymore.”

British Prime Minister Boris Johnson said, “Bangladesh is one of the fastest growing economies in the world and the UK and Bangladesh share the ambition to create an ever more prosperous and environmentally- sustainable future.”

Chinese President Xi Jinping said, “Bangabandhu has dedicated his entire life to his country and people. That is why he is so dear to the people of Bangladesh even today. His dream of a golden Bengal still inspires 160 million people in the development of Bangladesh.”

Sri Lankan Prime Minister Mahinda Rajapaksa called Bangladesh the economic lifeblood of South Asia.

“Bangladesh is situated at the crossroads of South Asia and the Indian subcontinent, and due to the country’s high economic growth in recent years, it has become an attractive destination for the Japanese business community,” said Japanese Prime Minister Yoshihide Suga.

The Prime Minister of Canada Justin Trudeau said, “But Bangladesh is much different today than when I first visited with my father in 1983. Over the past 50 years, your country has made incredible progress. You have spurred economic growth, reduced poverty, increased access to education and health resources and built new opportunities for your people.”

The Secretary-General of the United nations, H. E. Mr. António Guterres said, “People of Bangladesh have made tremendous strides over the past five decades, particularly on issues of social development. I congratulate you on this progress. I also congratulate you from graduating from the list of least developed countries”.

The Honorable President of the Republic of Maldives H. E. Mr. Ibrahim Mohamed Solih has said that “Bangabandhu sheikh Mujibur Rahman played the pivotal role to achieve the independence of Bangladesh. His charismatic leadership will remain everlasting in the memory of the people. His historical speech delivered on 7th March in 1971 has been inscribed by UNESCO in its International Memory of the World Register as a documentary heritage. Over the last half a century, Bangladesh has achieved remarkable development”.

The Honorable President of the Federal Democratic Republic of Nepal, H. E. Ms. Bidya Devi Bhandari told that, Bangladesh has been successful to eradicate poverty through achieving economic revitalization and development in recent years and Nepal, as an ally of Bangladesh, is extremely happy to see that.

Honorable Prime Minister of the Kingdom of Bhutan, H. E. Mr. Lotay Tshering said that, “I strongly believe that all of us, all human beings and for that matter all nations in the world must have a story to share. Bangabandhu Sheikh Mujibur Rahman has given Bangladesh a very good story to share with the global population. Prime minister Sheikh Hasina is an inspiring leader, a mother like figure for me. Bangladesh is truly blessed to have her as the leader”.

The president of the Russian Federation H. E. Mr. Vladimir Putin has said, “Bangladesh is celebrating 50 years of its independence and the birth centenary of Bangabandhu Sheikh Mujibur Rahman simultaneously. I am confident that it is our joint efforts through regional stability and security which will ensure further development of constructive bilateral cooperation which will bring benefit to both of us”.

The Prime Minister of the Kingdom of Cambodia H. E. Mr. Hun Sen has said, “Bangladesh was established as an independent country and started its journey towards prosperity through the pragmatic and visionary leadership of Bangabandhu Sheikh Mujibur Rahman. Following the path, he showed, his daughter and Hon’ble Prime Minister of Bangladesh Sheikh Hasina has consistently navigated the country to excel prosperity which has been articulated by achieving all the criterion to graduate as a developing country”.

The Prime Minister of the Islamic Republic of Pakistan H. E. Mr. Imran Khan has said, “The centenary and Golden Jubilee of Bangladesh remind us of far-sighted reconciliation and friendship between our two peoples so deeply cherished by the leaders of Pakistan and Bangladesh. We would like to fortify our existing bonds with the brotherly Bangladesh and build new ones for our succeeding generations as we believe the destinies of our two peoples are intertwined”.

The President of the Indian National Congress Ms. Sonia Gandhi has said, “Fifty years ago the courageous people of Bangladesh scripted a full new destiny for themselves transforming both the history and geography of the subcontinent. Over the past five decades, Bangladesh’s remarkable achievements in social development, community participation, economic growth and other areas have been very impressive and have received global recognition”.

The Secretary-General of OIC H.E. Mr. Yousef bin Ahmad Al-Othaimeen has said, “Bangabandhu Sheikh Mujibur Rahman envisioned to transform the newly independent Bangladesh into the land of prosperous Golden Bangla. His daughter and Hon’ble Prime Minister of Bangladesh Sheikh Hasina has been championing those dreams of achieving Golden Bangla into reality. Today, Bangladesh bears the example of world peace under her dynamic leadership”.

The Prime minister of the Republic of Korea H. E. Mr. Chung Sye-kyun has said, “International community has been deeply impressed to see that Bangladesh even in the midst of the COVID-19 pandemic when the world economy has slowed down, succeeded in achieving the greatest level of economic growth. Bangladesh and Korea have continued to nurture the ties of friendship over the last nearly half a century. Currently, Bangladesh is one of the emerging economies in the world. Bangladesh has achieved remarkable progress and development over the last half a century. The Republic of Korea will be a trusted friend to Bangladesh in moving forward to embrace the future together”.

The Queen of the United Kingdom H. E. Queen Elizabeth II has said, “On the special occasion of your 50th Independence Day, I am delighted to convey to your excellency my congratulations together with my best wishes to the people of Bangladesh. We share ties of friendship and affection which remained the foundation of our partnership and are as important today as was 50 years ago. After what has been a difficult year, I hope we may look forward to overcoming the global health challenges and to better times in future”.

The King of Jordan H. E. Abdullah Al Hossain said, “The past five decades witnessed a tremendous progress in all aspects of life in Bangladesh. A progress that reflects the resilience of the people of Bangladesh and wisdom of the leadership. We are confident that the future will see Bangladesh making even more strides and consolidating stability, achieving more development and realizing the great potential of its people”.

Madam Speaker

- Besides, all other world leaders who participated strongly praised the progress of Bangladesh. These world leaders have asked to follow the path of Bangabandhu’s ideology at a time when the whole world is in turmoil due to the Corona pandemic. They praised the achievements of Bangladesh in the 50 years of independence. They committed and hoped to become partners in Bangladesh’s future progress. In the last 50 years, especially during the three and a half years of Bangabandhu’s rule and the 17 years of visionary leadership of Hon’ble Prime Minister Sheikh Hasina, the size of Bangladesh’s economy has increased 271 times and our per capita national income has increased 300 times. Bangladesh has now earned a respectable position in the world. On this auspicious occasion of the birth centenary of the Father of the Nation and the golden jubilee of independence, we, the people of the country, express our humble gratitude to the Father of the Nation Bangabandhu Sheikh Mujibur Rahman and Hon’ble Prime Minister Sheikh Hasina.

Chapter Three

Graduating to the status of a developing country and the journey onward

Madam Speaker

Enrollment of Bangladesh in the list of LDCs

- The United Nations introduced the concept of Least Developed Countries (LDCs) in 1971 on the basis of per capita income, human resources and economic fragility, in order to accelerate the development process of the poorer countries which are backward in terms of socio- economic status. Although Bangladesh achieved independence under the leadership of Bangabandhu in 1971, the economic situation of Bangladesh was very fragile after 24 years of colonial rule and exploitation by Pakistan. Although Pakistan was developing, there was no touch of development in this part and made it literally a land of impoverishment and deprivation. Bangabandhu called upon all countries of the world to cooperate with Bangladesh to overcome this situation. Bangladesh was listed as a Least Developed Country in 1975 by the Father of the Nation for securing all the facilities of, and cooperation from, the comity of nations for its economic development.

Bangladesh becomes eligibile for graduation to a developing country Madam Speaker

- The UN Committee for Development (UNCDP) meets every three years to review on the least developed countries. In this meeting, three indicators of least developed countries, namely: (a) Per Capita Income- which is determined to be the average per capita national income of the previous three years according to the World Bank’s Atlas Method; (b) the Human Asset Index which is developed based on combined nutrition, health, mortality, school enrollment and education rates; and (c) Economic

Vulnerability Index, where the contribution of agriculture sector to the economy, export diversification, population ratio of coastal areas, natural disaster situation etc. are taken into consideration. In order to get the final recommendation for transition from a least developed country, a country needs to fulfil certain standards in two consecutive reviews of the UNCDP. If a country passes any two of the three indicators in two consecutive reviews or achieves double the national per capita income, the United Nations declares it eligible to graduate from the Least Developed Countries.

- Hon’ble Prime Minister Sheikh Hasina expressed her country’s determination to become a developing country after attending the 4th Conference of the United Nations Least Developed Countries held in Istanbul, Turkey during 9-13 May 2011. The successful implementation of the Istanbul Programmes on Actions (IPoA) adopted at the conference under the leadership of the Hon’ble Prime Minister has accelerated the transition of Bangladesh into a developing country.

- In 2018, Bangladesh achieved a per capita income index of US$1,274 against a minimum of US$ 1,230, in human resource index score of 73.2 against a minimum of 66 and in economic and environmental fragility index of 25.2 against a maximum of 32 score, thus becoming the first country to graduate from the list of least developed countries to developing countries.

- According to the UNCDP’s 2021 review, the per capita income criterion for qualifying is US$ 1,222 or more. But in the last three years, Bangladesh’s average per capita income has stood at US$ 1,827. The eligibility score in Human Asset Index is 66 or more. Here, Bangladesh’s score is 75.3. The score required to qualify on the Economic Vulnerability Index was 32 or lower. Bangladesh’s score now stands at 27.2. After securing eligibility scores in all indicators, Bangladesh has received the final recommendation to graduate from the list of LDCs at the UNCDP Triennial Review Meeting held on 26 February 2021. In the reviews of 2018 and 2021, Bangladesh has qualified to become a developing country after securing necessary scores in all three qualifying indicators. Therefore, Bangladesh will proudly join the list of developing countries in 2026 by graduating from the list of LDCs by fulfilling all three criteria.

Opening a new door for Bangladesh as a developing country Madam Speaker

- The most important aspect of Bangladesh’s transition from an LDC is the international recognition of the country’s socio-economic development, which was made possible by the right steps, policies and strategies of the government. The following important opportunities and possibilities will be created after the graduation:

- The graduation will lead to the development of self-confidence and self-esteem of the government and the people. This will inspire the people, which will help them reach a higher level of development.

- After the graduation, Bangladesh’s image in the outside world will brighten, which will help bring in foreign direct investment (FDI) and expand international trade.

- The graduation will increase the country’s credit rating, which will enable us to get low interest loans in foreign currency by issuing sovereign bond. The graduation will also increase productivity and competitiveness in foreign trade, which will help increase export earnings.

- Foreign investment will likely to increase, which will lead to massive infrastructure development in the country, job creation, and improved living standards.

- The absence of benefits as a least developed country will create a kind of compulsion to export diversification, resulting in the creation of new export products and markets.

- The product supply chain will be integrated and will create incentives and obligations to produce high value and high value- added products.

- The massive increase in the demand for skilled manpower will create an opportunity to create a workforce suitable for the Fourth Industrial Revolution.

- It will be easy to move the country forward by implementing a unified and inclusive development strategy with all stakeholders, including development and trade partners, the private sector and civil society.

Madam Speaker

Post-transition challenges as a developing country

- All the international opportunities that Bangladesh is currently enjoying as a least developed country will either be unavailable or be reduced in many cases after the transition from a least developed country. These include:

- In the case of trade, duty-free and quota-free market facilities; exemption from patent protection to the pharmaceutical industry under the WTO’s Trade Related Intellectual Property (TRIPS) Agreement; and subsidy on export products/industries will be reduced.

- Foreign loans and grants on concessionary terms will be reduced. However, since 2015 when Bangladesh became a low-middle income country in the World Bank’s classification, it has been taking conditional less concessionary loans along with soft loans.

Strategies to deal with the post-graduation situation Madam Speaker

- The good news for us is that we will have at least five years to deal with the challenges of transitioning from a least developed country to a developing country. According to the UNCDP’s recommendation, Bangladesh’s transition will be effective in 2026. In other words, until 2026, Bangladesh will be able to enjoy all these benefits applicable to LDCs. However, under the current rules, Bangladesh will be able to enjoy duty-free and quota-free market access for another three years, i.e. until 2029, after entering the EU market. During this period, traders in Bangladesh are expected to be able to improve their competitiveness in the international market. Our government will continue to provide all possible policy supports to businesses and provide new forms of assistance as needed. We have already incorporated the necessary strategies for this purpose in the 8th Five Year Plan and a detailed action plan is being prepared by the Economic Relations Division. The government has taken various steps to address the challenges that Bangladesh will face as a result of its graduation from an LDC, the details of which are as follows:

- At the request of our government, the UNCDP has recommended that against the backdrop of COVID-19 pandemic, the preparation period for the transition will be five years instead of three. During this period, that is, until 2026, all international facilities will continue.

- The LDC Group of the World Trade Organization (WTO) has put forward a proposal to ensure that all trade facilities pertaining to LDCs remain in force for another 12 years after transition. Bangladesh has actively participated in this process, and is continuing its efforts to get this proposal accepted.

- The government has already taken steps to avail the advantage of GSP+ in EU countries after the graduation. Initiatives have already been taken to sign preferential trade agreements with Bhutan and sign similar agreements with 11 other countries.

- Multiple steps are being taken to increase the overall competitiveness of the country’s trade and commerce. As a result, our products will survive in the international market by competing with products from other countries. Moreover, the government has taken effective steps to improve its ranking in the Ease of Doing Business Index to increase the flow of FDI. The benefits of these steps are becoming evident.

- The government has already taken steps to set up 100 special economic zones, high-tech parks for technological advancement and implementation of various mega projects including the Padma Bridge, which will help create new jobs and increase national income.

- Talks with development partners, trade partners and relevant international organizations will continue to ensure that some important international facilities remain available event after after the graduation.

- Training arrangements will be made for stakeholders to enhance their ability to deal with post-graduation situations. To develop human resources, steps will be taken to enhance efficiency as per the demand of the market at home and abroad.

- Steps have been initiated to conduct sector-wise research activities on the opportunities created by the graduation and what can be done to meet the challenges.

- Above all, as part of the preparation for the post-graduation period, the government has undertaken the task to formulate a graduation strategy through intensive discussions with all stakeholders, the private sector, development and trade partners, and civil society.

Madam Speaker

- On August 15, 1975, with the tragic assassination of the Father of the Nation, the country pluged into a long spell of backwarndess. It took us a long time to get rid of the stigma of the least developed country and become a developing country. After nearly 43 years, at the UNCDP Triennial Review Meeting held in New York on 12-16 March 2018, for the first time, it was officially recognised that Bangladesh has met all the criteria of the three indicators of transition from a least developed country. This has been made possible as a result of making unprecedented progress in almost all indicators of socio-economic development by the successful activities of the government run by the Bangladesh Awami League during the last one decade. At the UNCDP Triennial Review Meeting on 26 February 2021, Bangladesh received a recommendation to move from a least developed country with a final five-year preparatory period. On the golden jubilee of independence and the birth centenary of the Father of the Nation, it is the greatest achievement of the nation and the largest international recognition.

Chapter Four

COVID-19 Pandemic and Economic Recovery

Madam Speaker

- You are aware that the COVID-19 novel coronavirus has created an unprecedented global crisis which also affected Bangladesh. In the last fifty years after independence, Bangladesh has faced numerous ups and downs in her national life and finally achieved a level of socio-economic development. During the last 12 years of continuous development under the able leadership of the Hon’ble Prime Minister Sheikh Hasina, we have been able to reduce the poverty successfully and now on course to graduate from the list of LDCs. However, in this critical phase of our development, the COVID-19 pandemic has hit the economy and putting the momentum of our economic growth, poverty reduction and other socio-economic development at risk.

- Our first case of COVID-19 was identified in 8 March, 2020, but the virus started spreading in various regions of the world, including China, Europe, USA, as early as January of that year which impacted our economy negatively as export and import slowed down. Against this background, we acted at the very early stage of the pandemic. The first impact on our economy came in the form of cancellation and postponement of export orders of readymade garments that risked jobs of millions of workers in that sector. We acted upon very promptly and created an emergency fund of Tk. 5,000 crore on March 31, 2020 to provide salary support to the workers of the export-oriented industries. We also had to implement the strict social distancing measures during late March to mid-May last year to contain the spread of the virus which resulted in temporary closure of many businesses and as a result, the economy slowed down considerably. The Hon’ble Prime Minister, on 5 April, 2020, declared 4 economic recovery packages worth Tk. 67,750 Crore to combat the slowdown. In the last one year, we have gradually expanded the size and scope of the packages and brought newer affected sectors and affected population within the government support mechanism. So far, we have introduced 23 recovery packages with a combined value of Tk. 1,28,441 crore which is approximately 4.2 percent of GDP.

- Our comprehensive plan for recovery includes four main strategies. Firstly, we have discouraged luxury expenditures and prioritized government spending that creates job. Due to sound macro- fiscal operation by the government during the last ten years, our Debt-to- GDP ratio remans low which has provided us a cushion against increasing public spending to overcome the crisis. Secondly, we have created loan facilities through commercial banks at subsidised interest rate for the affected industries and businesses so that they can revive their economic activities and maintain competitiveness at home and abroad. Our third strategy was to expand the coverage of our social safety net programmes to protect the extreme poor and low paid workers of informal sector from the sudden income loss due to the pandemic. Our fourth strategy was to increase money supply to the economy.

- We took a consultative approach while designing these recovery packages and discussed extensively with business leaders, economist, development specialists, journalists, researchers and stakeholders form various backgrounds. In November and December of last year, we arranged a series of dialogue in three separate sessions to discuss the economic recovery packages. The important recommendations and suggestions came out in these dialogues were used in further modification and re-designing of the packages.

Madam Speaker

- In my last year’s budget speech, I presented a detailed description of the recovery packages we had introduced until then. Now, I am going to provide an update of the implementation status of those packages:

- We have fully utilized the salary support fund of Tk. 5,000 crore that was provided to retain jobs of export-oriented manufacturing industry workers, including readymade garments;

- We initially allocated Tk. 30,000 crore to provide working capital loans with a subsidised interest rate to the affected industry and service sector businesses which was later increased to Tk. 40,000 crore. Out of this, working capital loan of Tk. 32,591 crore has been disbursed as on 30 April, 2021. Similarly, Tk. 14,598 crore has been disbursed as of 30 April, 2021 out of the Tk. 20,000 Crore subsidised working capital loan designated for the Cottage, Micro, Small and Medium Enterprises (CMSMEs);

- The size of the Export Development Fund (EDF), introduced by the Bangladesh Bank, has been increased from USD 3.5 billion to USD 5.5 billion and so far, loan amounting to US$ 9.03 billion has been disbursed from this fund;

- We are giving special honorarium equal to the basic pay of two months to the doctors, nurses and other healthcare workers who are providing critical healthcare services to COVID-19 patients. As on April 2021, a total of 19,579 medical workers have received their honorarium totaling Tk. 49 crore;

- We are providing financial compensation to families of the deceased healthcare workers treating COVID-19 patients and deceased public servants from field administration, law enforcing agencies and armed forces and other employees of public services who were directly engaged in enforcing government’s COVID-19 measures. As on April 2021, families of 132 deceased public servants have received the compensation totaling Tk. 60 crore;

- We have made direct cash transfers of Tk. 2,500 each to 35 lakh selected poor families nationwide who faced sudden unemployment and income loss due to the pandemic;

- We have widened the coverage of the Old Age Allowances and the Allowances for Destitute Women by including all eligible persons in the poorest 100 upazilas in the country;

- We have introduced a programme to construct 81,643 homes for the homeless people around the country and already completed construction of 66,898 homes as of April 2021;

- We have set up an agriculture refinance scheme of Tk. 5,000 crore to provide required agricultural credit to farmers and as of April 2021, Tk. 3,936 Crore has been disbursed. Another refinancing scheme of Tk. 3,000 crore has been launched for small income farmers and traders in the agriculture sector and as of April 2021, Tk. 1,772 Crore has been disbursed;

- We have announced to provide interest subsidy of Tk. 2,000 Crore against loans distributed by all commercial banks to various affected businesses. As of April 2021, we have disbursed interest subsidy of Tk. 1,390 crore.

- At this stage of my speech, I would like to talk about some important new packages that our government has been implementing. We have noted a slow disbursement of working capital loan for the CMSME sector at the initial stage. To encourage the banks to extend loans to CMSMEs, we have introduced a credit guarantee scheme of Tk. 2,000 crore. We have also introduced a new and permanent social protection scheme worth Tk. 1,500 crore for the destitute workers of the export- oriented readymade garment, leather and footwear industries with financial assistance from the European Union. A new package of Tk. 1,500 crore has been launched to revitalize the rural economy and job creation which will be implemented by eight publicly owned specialized organizations. Decision has been taken to widen the coverage of the Old Age Allowances and the Allowances for Destitute Women by including all eligible persons in another 150 upazilas which will be implemented in FY2021-2022. To protect the livelihood of the poor during the second wave of the virus-surge, we have provided Tk. 2,500 to each family who were previously identified during the first wave. Similarly, we have provided Tk. 2,500 each to 97,500 farmers of 6 districts that are worst affected by the recent storm, heat wave and hail-storm. Besides we have provided financial assistance of Tk. 568 crore to the 4,07,402 dairy and poultry woners and 78,074 fishermen. Additionally, we are providing cash assistance of Tk. 75 crore to 1,00,600 teachers and employees of non- MPO general schools and 61,000 teachers and employees of independent ebtedai madrasas.

- Due to the initiatives taken by our government, a total of 5,81,95,211 citizens and 1,04,996 institutions have so far been benefited direcly (Annex ‘A’ Table-1). Commonwealth has recently named the Hon’ble Prime Minister among the top women leaders who has demonstrated extraordinary leadership to tackle the COVID-19 pandemic.

Madam Speaker

- In this connection, I would like to say something about the role of our development partners. We have regained the trust of the international community on our government led by our Hon’ble Prime Minister. We have found all of our bilateral and multilateral development partners by our side during this crisis. We have received about USD 2.6 billion as budget support during FY2019-2020 and FY 2020-2021 from our development partners to overcome the crisis. We are expecting to receive further USD 2 billion in the coming FY 2021-2022. In addition, we are going to receive US$ 1.5 billion as vaccine support to implement the COVID-19 vaccination programme of the government. The Government of Japan, the Government of South Korea, the Asian Infrastructure Investment Bank (AIIB) and the OPEC Fund for International Development (OPEC Fund) has extended budget support to Bangladesh for the first time. It has been easy for the development partners to extend support in such a way because of our low debt-to-GDP ratio and our debt carrying capacity. I would like to express our sincere gratitude, through you, to our development partners.

Chapter Five

Perspective and Background: Global Economy and Bangladesh

Madam Speaker

- We are presenting the budget of FY2021-2022 against the backdrop of global crisis stemmed from the ongoing COVID-19 Pandemic where countries around the world are battling with second and third wave of the pandemic. The epicenter of the pandemic has recently shifted towards Asia, particularly to South Asia region that is also impacting Bangladesh.

- It is very encouraging for us that both International Monetary Fund (IMF) and the World Bank has upgraded economic growth forecast for Bangladesh compared to their previous forecasts. According to IMF, global economy will grow by 6.0 percent in real term in 2021 and 4.4 percent in 2022. Whereas, their forecast for Bangladesh is 5.0 percent in 2021 and 7.5 percent in 2022. The World Bank forecasted global GDP growth at 4.0 percent and Bangladesh’s at 3.6 percent in FY2020-2021, and also forecasted Bangladesh’s GDP growth at 5.1 percent for FY2021- 2022. The Asian Development Bank has forecasted Bangladesh economy to grow by 5.5 to 6.0 percent in FY2020-2021 and 7.2 Percent in 2021- 2022.

- In spite of the pandemic, the government of Bangladesh, led by the able leadership of the Hon’ble Prime Minister Sheikh Hasina, has been able to maintain the macroeconomic stability of the economy with prudent fiscal policy and accommodative monetary policy. In the last fiscal year, we have been able to achieve the real GDP growth of 5.2 percent which is highest in Asia. Budget deficit during this period was 5.5 percent of GDP which was well within sustainable limit and the public debt-to-GDP was as low as 35.98 percent. We have been able to achieve revenue growth of

12.87 percent in the first 10 months of the current fiscal year compared to the same period of the previous year. Similarly, export has registered the growth of 8.74 percent in the first 10 months (July-April) and import grew by 6.06 percent during the July-March period. Remittances registered growth of 40.1 percent until 31 May, 2021 compared to the same period of the previous fiscal year and the official foreign exchange reserve exceeded USD 44 billion. During the July-February period of FY 2020-21, the current account balance has seen a surplus by US$ 1.557 billion. Private sector credit has seen growth of 8.79 percent during July-March period compared to the same period of the last fiscal year. Overall inflation, including the price level of essentials also remained stable. The point-to- point inflation on March 2021 was 5.47 percent and we are seeing a declining trend in food inflation due to good harvest of Boro rice. GDP per capita in FY2020-21 has risen to US$2,227, which is higher than that of many of neighbouring countries. This success of the government to maintain the macroeconomic stability has been praised by the international community. According to an IMF report, Bangladesh is one of the three countries of the world that has achieved highest economic growth in 2020. According to the World bank, “Bangladesh economy shows early signs of recovery amid uncertainties”. The Wall Street Journal has recently published article titled “Bangladesh is Becoming South Asia’s Economic Bull Case”. The Indian Express reported “Bangladesh: From a ‘Basket Case’ to a Robust Economy”. The New York Times published an op-ed article on 10 March, 2021 titled “What Can Biden’s Plan do for Poverty? Look at Bangladesh”.

- The positive outlook of the economy of Bangladesh in the recent time has clearly indicated that the timely and effective economic recovery effort of the government led by the Hon’ble Prime Minister has resulted in job retention and job creation, stimulated domestic demand and helped maintain the momentum of economic activities. We will be able to able to overcome the ongoing crisis of the second wave through mass vaccination.

The government believes that, every challenge creates lots of opportunities and windows for moving forward. So, there will be new opportunities for us from the scars of COVID-19 global pandemic and the government will take every necessary step to utilize those.

- The main impetus of our economic activities is our people. So, this year’s budget will provide highest importance to the lives and livelihoods of the people. With the improvement of the socio-economic condition of the people, we will achieve our planned targets of 2030 (sustainable development goals), 2031 (upper middle income country), 2041 (high income country) and 2100 (implementation of Bangladesh Delta Plan).

Chapter Six

The Supplementary Budget

Madam Speaker

- Now, I am going to present the Supplementary Budget for the current FY2020-2021 and the proposed Budget Framework for the FY2021-2022.

The Supplementary Budget for the current FY 2020-2021 Madam Speaker

- The targets for the revenue earning and expenditure of the current FY2020-2021 were set based on the assumptions that various reforms taken in the revenue sector, especially the new VAT and Supplementary Duty Act from July 2019, would be fully implemented, and the country’s economy would be able to make recovery from the impact of the coronavirus. However, due to the continuation of the COVID-19, particularly the effects of the second wave of coronavirus, we anticipate that the revenue income and expenditure targets may not be achieved. The amount of revenue collected upto February 2021 of the current fiscal year was 41.0 percent of the original annual target. At the same time, government expenditure was 35.5 percent of the annual allocation. Considering the above situation, a brief description of revisions and adjustments made in the budget of FY2020-2021 is presented in Appendix ‘A’: Table-4.

- Revised revenue income: The target of revenue collection for FY2020-2021 was set at Tk. 3,78,000 crore. After reviewing the revenue collection situation during July-February of the current financial year, the target was reduced by Tk. 26,468 crore, and refixed at Tk. 3,51,532 crore.

- Revised expenditure: The total government expenditure for FY2020-2021 was set at Tk. 5,68,000 crore. In the revised budget, the expenditure was reduced by Tk. 29,017 crore, and revised at Tk. 5,38,983 crore. The size of the annual development program (ADP) was reduced by Tk. 7,502 crore from the original allocation of Tk. 2,05,145 crore, and set at Tk. 1,97,643 crore. On the other hand, the continuation of the COVID- 19 pandemic has led to increased expenditures related to the health sector and implementation of various stimulus packages. However, the estimation of other expenditures, including operating expenditure, was reduced to Tk. 21,515 crore through cost minimisations in less important sectors.

- Revised budget deficit and its financing: The budget deficit for the current fiscal year was estimated at Tk. 1,90,000 crore. The deficit in the revised budget has been set at Tk. 1,87,451 crore, which is 6.1 percent of GDP. Against the original budget deficit, the estimation for external financing was Tk. 80,017 crore, which has been reduced to Tk. 72,399 crore in the revised budget. From domestic sources, the estimation of financing from the banking system is Tk. 79,749 crore.

Chapter Seven

Proposed Budget Structure of FY 2021-2022

New Budget starts (salient features)

Madam Speaker

- The global economy has been put at severe risks due to the prolonged effects of the COVID-19 pandemic and its second wave in different countries around the world. The budget for FY2021-2022 has been prepared keeping in consideration the strategies taken to facilitate the recovery in various sectors of the Bangladesh from shocks of the COVID- 19 pandemic, especially to meet the challenges arising in the health sector and the issue of the application of vaccine. Allocation has been made in the proposed budget to meet the targets of each ministry and divisions to address the adverse effect of the COVID-19 pandemic.

Madam Speaker

- I will now present an outline of the proposed income and expenditure for the next fiscal year 2021-2022, which has been presented in detail in Appendix ‘A’: Table-5.

- While presenting the budget for the previous fiscal year, I highlighted a number of reform initiatives taken in tax revenue management. We have started implementing those reforms this year. However, we could not successfully complete them due to the continuation of the COVID-19 pandemic throughout the fiscal year. I would like to continue all these reform programs in the coming fiscal year.

- We have been implementing the new VAT law since July 2019. To achieve success in this endeavour we will continue with the programs in the next FY2021-2022 to deploy necessary manpower, provide equipment and logistics and enhance skills. The largest portion of government revenue is collected through the National Board of Revenue (NBR). Therefore, necessary steps will be taken to build institutional capacity of the NBR, and priority will be given to the tasks of business process automation in the next fiscal year.

- Although a large section of our population can afford to pay taxes, the number of taxpayers is currently 25.43 lakh. Hence, emphasis will be given in the next budget to bring them under the tax net by taking necessary steps to prevent tax evasion. Moreover, our Tax-GDP ratio is low compared to that in other similar economies. Measures will, therefore, be taken to increase the Tax- GDP ratio at a reasonable level.

Madam Speaker

- I expect that once the National Parliament approves the proposed Customs Act, we will implement it in the next fiscal year.

- Bearing in mind the realities highlighted above and relying on all of our planned and reform-oriented tax management, we have set the target for total revenue income in the fiscal year 2021-2022 at Tk. 3,89,000 crore, which is 11.3 percent of GDP. Out of this, Tk. 3,30,000 crore will be collected through the NBR sources. Tax revenue from non- NBR sources has been estimated at Tk. 16,000 crore, while the non-tax revenue is estimated to be Tk. 43,000 crore.

Madam Speaker

- In FY2021-2022, the size of the total expenditure has been estimated at Tk. 6,03,681 crore, which is 17.5 percent of GDP. Total allocation for operating and other expenditures has been set at Tk. 3,78,357 crore, while the allocation for the annual development program is Tk. 2,25,324 crore.

- Health, agriculture and employment generation have been given priority while allocating resources for the ADP. The sectoral allocation of the ADP for the next fiscal year is presented in Table 6 of Appendix ‘A’. I propose to allocate, from the ADP of FY2021-2022, 29.4 percent for human resources sectors (education, health and related others), 21.7 percent for the overall agriculture sector (agriculture, rural development and rural institutions, water resources and related others), 12.1 percent for the power and energy sector, 26.4 percent for communication (roads, railways, bridges and other communications related), and 10.4 percent for other sectors.

- The overall budget deficit for FY2021-2022 will be Tk. 2,14,681 crore, which is 6.2 percent of GDP. It is to be mentioned that this ratio in last financial year was 6.1 percent. Out of the total deficit, Tk. 1,01,228 crore will be financed from external sources, while Tk. 1,13,453 crore from domestic sources of which Tk. 76,452 crore will come from the banking system and Tk. 37,001 crore from savings certificates and other non-bank sources.

Madam Speaker

- Overall expenditure framework: I will now present the overall expenditure framework (operating and development) of the proposed budget. In line with the allocation of business of different ministries and divisions, government activities have been categorised into 3 main sectors, namely: social infrastructure, physical infrastructure and general services.

- Allocation proposed for the social infrastructure sector in the proposed budget is Tk. 1,70,510 crore, which is 28.25 percent of total allocation, in which allocation for human resources sector (education, health and other related sectors) will be Tk. 1,55,847 crore. Allocation proposed for the physical infrastructure sector will be Tk. 1,79,681 crore or 29.76 percent, in which Tk. 74,102 crore will go to overall agriculture and rural development, Tk. 69,474 crore to overall communications, and Tk. 27,484 crore to power and energy. A total of Tk. 1,45,150 crore has been proposed for general services, which is 24.04 percent of the total allocation. Tk. 34,648 crore is proposed for public-private partnerships (PPP), financial assistance to different industries, subsidies, equity investments in state-owned, commercial and financial institutions, which is 5.74 percent of the total allocation. Tk. 68,589 crore for interest payment, which is 11.36 percent of the total allocation. Tk. 5,103 crore for net lending and other expenses, which is 0.85 percent of the total allocation. Detailed information about the allocations has been presented in Table 7 of Appendix ‘A’. A ministry/division-wise proposal for budget allocation has also been provided in Table 8 of Appendix ‘A’.

Chapter Eight

Sectoral Strategies, Action Plans and Resource Mobilisation

Madam Speaker

- I would now like to present a brief account of our important policy-strategies, workplans and budget allocation for the medium-term including the next fiscal year. Through this budget, we will undertake initiatives to combat the impact of the second wave of the COVID-19 pandemic and its long term impacts, fulfill the pledges made in our Election Manifesto of 2018, the 8th Five Year Plan and the 2nd Perspective Plan (2021-2041), and achieve Sustainable Development Goals and their targets. We have already begun implementing the 8th Five Year Plan. Therefore, its implementation will get special importance in this budget. Besides, we will give priority on those expenditure programmes that facilitate economic recovery by combating the long-term impacts of the pandemic, and ensure basic needs of the people by protecting lives and livelihoods.

Medium-Term Policy Strategy

- Bangladesh’s sustained achievement of high GDP growth in the last decade has been halted temporarily due to the effects of the COVID- 19 pandemic. Even though we achieved a record 8.15 percent growth in FY2018-2019, it has slowed down to 5.2 percent in FY2019-2020 due to the pandemic. The GDP growth rate was originally estimated to be 8.20 percent for FY2020-2021 on the assumptions that the economy would recover from the impact of the pandemic. But the economic activities slowed down and the expected momentum in import and export activities did not take place due to the continuation of the impact of the pandemic and the surge of its second wave and resulting lockdowns in various countries in the world including Bangladesh. However, considering the better-than-expected growth in remittances and the implementation of the large stimulus packages by the government to facilitate economic recovery, the GDP growth rate has been revised at 6.1 percent for the current fiscal year. Alongside, the growth rate for FY2021-2022 has been fixed at 7.2 percent remaining consistent with the government’s long-term plan and taking the post-Covid recovery situation into account. It is expected that the inflation rate will be 5.3 percent during the period.

- In the medium-term, strong domestic demand will be the main source of our growth. Our focus will be on increasing consumption and investment to stimulate domestic demand and enhancing exports to augment external demand. Growth in remittances will also continue in the medium-term. Our aim is to develop improved transport structure and ensure power and energy security through public investment. On the other hand, acceleration of the GDP growth and creation of employment by increasing the supply side growth of the industrial sector are among our main targets. We hope that these targets will be achieved through the rapid implementation of the works to establish Economic Zones.

- The next budget will be the 2nd year of the implementation of the 8th Five Year Plan. The first stage of the Perspective Plan (2021-2041) framed in line with the ‘Vision 2041’ of the Hon’ble Prime Minister will be materialised through the implementation of the 8th Five Year Plan. Successful implementation of the 8th Five Year Plan will, on one hand, lay the foundation of ‘Vision 2041’, and help achieve the targets of SDGs and Bangladesh Delta Plan-2100 on the other. Moreover, a special emphasis has been given in this Plan on achieving higher economic growth, increasing income, creating employment and implementing poverty reduction strategies by addressing COVID-19 challenges. Further, to promote inclusive growth, guidelines have been framed for implementing programmes on development of labor-intensive and export- oriented industries, diversification of agriculture, flourishing of the services sector, development of ICT-based entrepreneurship to embrace 4th Industrial Revolution and creation of overseas employment. The main foundation for successful implementation of this Plan lies in attracting domestic and foreign investment in the private sector, and to that end, the government will strive to create an investment-friendly environment.

Alongside, priority is given to increase public investment, particularly the size of the Annual Development Programme. To implement the Annual Development Programme, priorities are given on strengthening the health sector infrastructure, establishing the social safety net and removing infrastructural bottlenecks to promote private sector investment and accelerate economic growth. Furthermore, the Plan also laid emphasis on agenda, such as establishment of Digital Bangladesh, development of human resources, promoting good governance in public enterprises, etc.

Madam Speaker

- Like last year, we have made a slight deviation from the traditional budget for the sake of effectively combatting the COVID-19 pandemic and resolutely overcoming its economic impact by giving priority to protection of lives and livelihoods. In this regard, I would like to mention that a structural change in the priority of the government has been brought in the next year’s budget. The health sector has been given the highest priority to address the impact of the COVID-19 pandemic, and necessary allocations have been made in the next budget. Our second highest priority is to continue with the implementation of the stimulus packages declared by the Hon’ble Prime Minister to address the impact of pandemic. Agriculture is our third highest priority sector in order to ensure food security. To achieve this aim, activities such as farm mechanisation, incentives for irrigation and seeds, rehabilitation of agriculture, and provision of subsidies on fertilizers, etc., will be continued to increase food production. Our fourth priority sector is the overall development of human resources including education and skills enhancement. Our fifth priority sector will be rural development and job creation. We have given special importance on tackling unemployment in the industry, SMEs and services sectors and the rural non-formal sector owing to disruption in overall economic activities due to the COVID-19 pandemic, and implementing various programmes for expatriate Bangladeshis who have been forced to return from abroad. In addition, priorities are given to build houses for the homeless people and distribute foodstuff free of cost or at subsidised prices among the low income people as well as expand the coverage of social safety net programmes.

Madam Speaker

- One of the basic commitments of our government is to achieve higher economic growth through sustainable and inclusive development. In formulating the budget, priority is given to implement plans for the creation of investment-friendly environment, promotion of export, business-friendly tax management, reforms in the financial sector and increase public investment, i.e. the sized of the Annual Development Programme with the aim of achieving higher growth. Another important goal of the government will be to strive for timely implementation of all nationally important projects including mega projects in the infrastructure sector, such as the Padma Bridge, Padma Rail Link Bridge, Dohajari- Cox’s Bazar Railway construction, the Rampal power plant, Rooppur Nuclear Power Plant, Payra Sea Port, the Matarbari Power Plant in Moheshkhali, and Dhaka Metrorail, etc. to sustain the higher growth rate. Alongside achieveing growth, our aim is also to bring qualitative change in the lives of people through the alleviation of poverty and reduction in inequality. To this end, strategies such as increasing the coverage of social safety net programmes, creation of local and overseas employment, microcredit, and skills training will receive higher attention. Like each year, the Medium Term Macroeconomic Policy Statement, containing our medium term policy strategy has been presented with the budget speech.

- In the next section, I will present sector-based specific action plans.

Action Plans and Resource Allocation

Health and Family Welfare

Madam Speaker

Addressing the COVID-19 pandemic and protecting public life

- You are aware that the whole world has been passing a critical time since the first half of 2020 due to the impact of the COVID-19 pandemic. At the moment, the second wave and even the third wave of the pandemic have made the protection of public life even more difficult and critical. Bangladesh is no exception. Although the infection rate of coronavirus, which started in early March of 2020, went down to some extent in the beginning of the current year, it started rising again with the second wave since the 2nd week of March 2021, which is continuing till date. Considering the impact of the pandemic on public health and public life, we took preparatory measures during the first wave to address the COVID situation. Enforcement of countrywide general holidays for 66 days and adoption of proper measures, under the directives of the Hon’ble Prime Minister, to reduce the infection rate and provide treatment to the infected patients, it was possible to control the infection and death rates.

- During the second wave of the pandemic, under the direction of the Hon’ble Prime Minister, countrywide lockdown was enforced again during 5th April to 30th May 2021 against the backdrop of an abnormal increase in infection rates. During this time, public movement were strictly controlled to protect public health and public life, and ban on all modes of inter-district transport – rail, road, and air was also enforced. However, to keep economy moving by allowing people to earn their livelihoods, mills and factories were allowed to maintain production following strict health guidelines, and shopping malls, markets and offices were kept open for a certain period of the day. Due to these measures, it has been possible to keep the infection rate under control even during the second wave. During the pandemic, we will continue adopting strategies to protect public health and the lives of the people. Alongside, we will lay utmost emphasis on implementing various activities in the health and family welfare sector in line with the medium and long term plans.

- During the critical period of the pandemic, the government has strengthened its efforts to ensure affordable health services for all citizens through the development of the health, nutrition and population sector. As a result, it would be easier to achieve the aim of the government in building a healthy, strong and active society. When the coronavirus infection was first detected in Bangldesh in March 2020, the National

Preparedness and Response Plan was prepared to combat and control the virus. Later on, with some minor revisions, the Bangladesh Preparedness and Response Plan was finalised, and activities are currently being carried out in accordance with the Plan. During the second wave of the pandemic, medical treatment services have been continued in specialised isolation units in district and upazilla levels, 14 COVID-19 dedicated hospitals in the capital city, and 67 COVID-19 dedicated hospitals in the district hospitals which were established during the first wave of the pandemic last year. Alongside, 55 laboratories established in the last fiscal year and improved government healthcare institutions are providing COVID-19 services. Nine new COVID-dedicated hospitals have been established. As a result, a total of 89 COVID-dedicated hospitals are now in operation. Dhaka North City Corporation Specialised Hospital and Isolation Centre has been opened to provide quick treatment to patients who got infected during the second wave of the pandemic. This hospital has 200 ICU beds, 250 high dependency units (HDUs) beds, an emergency ward with 56 beds, and 395 isolated general beds.

Madam Speaker

- All incoming passengers are being scanned at the points of entry, such as airports, land ports and sea ports. Till date, 22.22 lacs international passengers who arrived through the country’s 3 international airports, 2 seaports, 2 railway stations, and 23 land ports have been screened. Samples for detection of COVID infection are being tested in a total of 121 public laboratories, of which 72 are located in Dhaka and 49 outside Dhaka. Till date, 59.48 lakh people have been tested for COVID infections, including 58.19 lakh tested through RTPCR. Isolation beds, 5 in each upazilla, have been set up in all Upazilla Health Complexes. Around 10-12 isolation beds have been kept ready in District Sadar Hospitals where there is no Medical College. As a result, COVID infected patients from remote areas are getting proper treatment. Distribution of Tk. 850 crore allocated in the current fiscal year for payment of compensation to the doctors, nurses and other officials who have died on duty and payment as honorarium to the doctors, nurses and health workers are underway. Two institutional quarantine centres have been kept operational. In addition, a total of 629 quarantine centres are prepared in different districts and upazillas. 10 guidelines on COVID-19 matters, 28 instructions, 4 SOPs and 13 public awareness building leaflets have been prepared. Due to the setting up of real time hospital dashboards in the hospitals across the country, all information on general and ICU beds in COVID hospitals are now instantly available. Moreover, the online verified test report system has been established during the COVID-19 pandemic.