Reform in strategic purchase of health care

HEALTHCARE financing is the backbone of the healthcare system. The other health system components are (1) inputs: (i) human resources for health, (ii) medicine, (iii) technology including diagnostics and (iv) physical infrastructure; (2) processes: (i) leadership or stewardship, (ii) governance and (iii) health management information system, which, however, by application comes later, when the system starts churning out outputs (health management information system covers input, process, output and outcome-based information); and (3) the output of the system, in one broad stroke, is the health services, which are results as the inputs are exploited under efficient governance and leadership.

Five models of healthcare financing known globally are the Beveridge model, the Bismarck model, the national health insurance scheme, the personal health insurance and the out-of-pocket payment. The merits and demerits of the models will be discussed to provide a platform of understanding for any reforms in future in healthcare financing.

UK National Health Services management process

IN THE United Kingdom, the prime minister’s office decides how much money will be given for the National Health Services and what will be the top-level priorities. The Care Quality Commission acts as an independent regulatory body for the services. Care providers report to the secretary of the health department and others at other tiers. The commission registers care providers and monitors, inspects and rates their services. The commission also publishes independent views on major quality indicators. The NHS England, as the regulatory body, oversees the funding, planning, delivery, transformation, and performance of NHS services. The NHS England regional teams have been responsible for the quality, financial, and operational performance of all NHS organisations in respective regions, working with the integrated care systems to support an ongoing integrated services development for a few years. Integrated care partnerships are local and regional partnerships of organisations that jointly plan and deliver health services-the integrated care systems. The Health and Care Act 2022 was promulgated based on several years of experience of locally led developments to create statutory integrated care systems across England.

At the base, the primary care networks across England are based on general practitioner registered patient lists of 30,000 to 50,000 people each. The general practitioners are gatekeepers of the healthcare system. General practitioners are funded through the National Health Services. Additional funds come for them through primary care networks and locally commissioned services. Most general practices are operated by a partnership of two or more general practitioners. Individual general practitioners or partners are contracted to the NHS to provide primary care services. The contract is negotiated every year between the National Health Services and the general practice committee of the British Medical Association. General practitioners are paid for the mandatory services and for additional and out-of-hours services when agreed. Their additional income also comes from, eg, the quality and outcomes framework scheme. When general practitioners form groups, the groups pay all their salaried employees, ie, general practitioners that are not partners, nurses, administration staff, etc and also the cost of running the premises from their income.

The balance amounts are distributed among the general practice management partners, based on sessions each management and care-providing partners work for. The managers of general practice partners get their share from the profit and are personally liable for any losses. Although majority of general practitioners are still independent contractors of the National Health Services, because of the advent of the alternate providers of medical services contract, private companies that have a variety of healthcare concerns, including those outside the National Health Services, have begun to take over the responsibility of primary care. Many NHS consultants also offer private treatment outside NHS hours or at a different place. No mix of different parts of the same treatment plan between the National Health Services and private care is allowed.

All NHS hospitals are managed by acute care and mental health providers, specialists or community trusts, including ambulance trusts. Many trusts run more than one hospital. The National Health Services buys services from private hospitals, if deemed necessary.

UK NHS financing strategy

WILLIAM Henry Beveridge, born in Rangpur in the erstwhile East Bengal, where his father was a civil servant in the late nineteenth century, enunciated the National Health Services. He was a British economist and social reformer, popularly known as a social economist. His 1942 report recommended the creation of a ‘comprehensive health and rehabilitation services for prevention and cure of disease,’ around which a cross-party consensus emerged in the United Kingdom.

Beveridge model

THE Beveridge model is the public tax-based payment process for health care for everyone in the United Kingdom, like, nevertheless, the incompletely or partly provided public health care in Bangladesh. The service recipients do not have to pay for the care they receive, except for prescription, dental and optical service charges. Local income, if generated, come from car parking charges, selling of property, private provision of services through the National Health Services, etc. Completely free services are provided for people aged over 60 years, or those on state benefits. A percentage of national insurance contributions cover some patients.

The expenditure on health care providers in the United Kingdom is 45.6 per cent of the total healthcare expenditure and the total healthcare expenditure is 10.2 per cent of the gross domestic product. In France and Germany, it is between 10.6 and 11.2 per cent.

The Beveridge model is practised in Spain, Italy, Scandinavian countries and New Zealand.

Bismark model

THE Bismarck model is also known as ‘social health insurance for everyone,’ as even the unemployed is covered for health care through public fund. This system does not make any profit. It is basically a system of the payment of insurance premium by the employer and employees at an agreed ratio, or through private insurance by richer patients. Co-payment is applied to inpatient care and medicine universally. No subsidy is given from the public sector for those who are covered through for profit private health insurance but their employers also cover part of the insurance cost. Military members, police personnel and other public-sector employees are covered under small programmes that are separate from the statutory social health insurance.

Social health insurance covers indoor and outdoor hospital care, mental health, preventive health, including vaccination and cancer screening, check-ups for chronic diseases, children, dentistry, pregnancy care, optometry, physiotherapy, rehabilitation, palliative care, and sick leave compensation. ‘Medically necessary’ public health care is covered through social security contributions. As both the social health insurance and privately insured get services from the same providers, the social health insurance care recipients get some cross-subsidy in the form of co-payment waivers, from the portion of private care. The government decides and monitors the ceiling of service fees and private insurance premiums. Overall, the social health insurance funds come from private source, employer-employee contributions, and national/subnational taxes.

In the Bismarck model the government contracts the health maintenance organisations, which are private-sector care managers. Health maintenance organisations collect the insurance fund to pay the care providers. Health maintenance organisations are selected through competitive approach, discernible deductibles and bonuses are offered by the competitors to win the bid. About 13.5 per cent of the total health expenditures comes as co-payments, which is, in fact, an out-of-pocket expenditure and is paid for nursing homes, medicines and medical aids. No co-payment is applicable to preventive care. The co-payment is used as an instrument in some developing countries to prevent undue use or moral hazard, that ensue from free or low-cost medical care).

The social health insurance approach is governed by a law passed in 1883, by the Otto von Bismarck government. In social health insurance, service-related decisions are taken by the federal, state, the fund managers, service provider organisations and patient representatives having only advisory role, jointly.

The Bismarck model is followed in Austria, Switzerland and then Czech republic.

National health insurance scheme

THE national health insurance scheme, like the other two models, provides financial protection and universal access to equitable, affordable and quality health care (universal health coverage). Under the national health insurance programme, governments ensure compulsory health insurance for all directly or indirectly.

The national health insurance scheme is managed by the public sector, the private sector, or a combination of both. Funding mechanisms vary with the particular programme and country. It is established through a national legislation. In Australia and South Korea, contributions to the system are made via general taxation and, therefore, are not optional. If national health insurance scheme offers a choice of multiple insurance funds, the rates of contributions may vary and the person has to choose which insurance fund to belong to.

In France, compulsory contributions are made, but the collection is administered by non-profit health management organisations. In Canada, the payment is made by the government directly from tax revenue. It is a single-payer for health care, which, therefore, has a strong bargaining power with the care providers. The provision of services, including hospital services are given through public — regional or municipality authorities — non-profit or private providers. Developed in 1946–1971, the Canadian health plans were promoted by federal governmental cost-sharing and national standards for a comprehensive care package. The plans were initially financed by taxation and premiums. While some states have abandoned premiums others still continue the approach. The negotiated fee-for-service based care is provided by private medical practitioners. Block budget-based payment is made, with no-specific budget line.

Care providers under the national health insurance scheme must provide a minimum standard of coverage and are not allowed to discriminate between patients by charging different rates for differences in age, occupation, or pre-existing medical conditions. To protect the interest of both patients and insurance companies, the government, as regulators, spreads risks between the various funds. The government may also contribute to this pool as a form of health care subsidy. This is the model used in the Netherlands.

The national health insurance schemes have the advantage of creating a big pool of fund that helps in risk distribution more efficiently. Healthcare costs tend to be high at the extremes of age and other specific events in life, eg maternity related services. In the national health insurance scheme, these costs are covered by contributions, made by the beneficiaries to the pool, based on the earning levels. This differs from the private insurance schemes with varying contribution rates, according to health risks, which are higher in old age, risky family history, previous illness, obesity, etc. In addition to direct medical costs, some national insurance plans also provide compensation for loss of work due to ill-health, or cover pensions, unemployment, occupational retraining, and financial support for students.

Out-of-pocket and private insurance payment

THE out-of-pocket payment is the most inefficient, regressive and expensive mode of payment for health care as the purchasers cannot negotiate the price and they cannot assess the worthiness of the services bought. The private insurance approach to buy health care may also be fraught with the same problems, unless regulated by a non-beneficiary agency.

Benefits, constraints and caveats in healthcare purchase

THE public tax-based care is said to be the most efficient technique of buying health care. But even this approach has loopholes. Public subsidies and national health insurance increase the demand for health services. The National Health Services or single-payer national health insurance scheme provides governments with relatively effective tools of cost-containment and health planning as the national health budget constitutes a hard constraint on health spending, less regulation of providers and also holding expenditures in check. A centralised public authority for investment decisions has facilitated national planning and the regionalisation of hospitals. These policies, however, limit and guide the distribution of highly-specialised personnel and equipment concentrated at regional centres. Expenditure curtailment may also have a down side — long waiting lists and complaints about the quality of services.

The multi-layer payment system is a drawback of the Bismarck model of healthcare financing as fund collection for the statutory care is managed through a third party — the private sector — although on a competitive platform, and which does not allow any profit. In any case, the same providers are employed for both the statutory and the privately insured patients which ‘absorbs non-profitability’.

An efficient purchaser of health care and contract manger has to know a few basic things, which are (1) a single pool or purchasing offers several advantages, including greater efficiency and capacity for cross-subsidisation and enforcing purchasing conditions on the provider whereas a fragmented pooling systems without risk sharing can work against equity goals in financing, because each pool has an incentive to enrol low-risk people and the parts of the population that receive more benefits are unwilling to share their funds with the population that are worse off; (2) risk equalisation happens when the central government allocates funds for health equitably. The people in richer regions with fewer health problems contribute more to the pool through taxes while those living in poorer regions with greater health problems receive more than they contribute. Some countries use complex allocation formulae to decide what are fair allocations to the various geographical areas and facilities; (3) the need for health care during a crisis increases while public revenues fall. When government spending on health falls, burden shifts to patients to foot the bill, which may compel them to forego needed care or they may incur catastrophic spending; (4) health care financing should redistribute disposable income and redistribution occurs when payment for health is compulsory, not voluntary and independent of utilization, most effectively when health care is at least partly financed from government tax; (5) if tax liability rises disproportionately with gross incomes, the post-tax distribution of income will be more equitable than the pre-tax distribution; (6) healthcare financing should have social welfare/standard of living enhancing effect, which is reduced if out-of-pocket expenditure is voluntary; (7) a healthcare financing scheme should reduce Gini co-efficient gap — the lower the post-payment Gini co-efficient gap, the more the redistributive effect, provided other regressive factors remain static, eg out-of-pocket expenditure; (8) the selection of service providers through open bidding may restrict innovations in the provision of health care. It may also discourage procurement of the state-of-the-art technology for serving the clients. Purchasers of health care need to understand that too much of cost control may discourage innovation. Quality difference may also be ignored in open bidding, especially when the quality indicators are not precisely asked for and assessed.

Payment mode for healthcare purchase and predicament

Salary: Service providers who work on salaries do not have any incentive to serve higher number of patients and no incentive to provide quality service.

Fee-for-service: It is the most traditional healthcare payment model. It requires patients or service purchasers/payers to reimburse the healthcare provider for each service performed. There is no incentive for the provision of preventive care to prevent the deterioration of the patients’ condition that may take them to the stage of hospitalisation or to take any other cost-saving measures.

Pay-for-coordination such as the general practitioner system, between the primary care provider and specialists: Coordinating care between multiple providers can help patients and their families manage a unified care plan and can help reduce redundancy in expensive tests and procedures.

Pay-for-performance or value-based reimbursement: Healthcare providers are only compensated if they meet certain quality and efficiency indicators. This conditionality ties physician reimbursement directly to the quality of care they provide

Bundled payments: It reimburses healthcare providers a set amount of money for specific episodes of care, such as an inpatient hospital stay. This model encourages the efficiency and quality of care as there is only a set amount of money to pay for the entire episode of care.

Shared savings programmes: These provide incentives for providers for specific patient population. A percentage of any net savings realised is given to the provider: (a) the upside-only shared savings is the most common, eg medicare shared savings programme. Medicare shared savings programme is usually managed through what is called an accountable care organisation. Accountable care organisations are groups of physicians, hospitals and other healthcare providers that come together voluntarily to give coordinated high-quality care to the medicare patients they serve in the United States. Coordinated care helps ensure that patients, especially the chronically ill, get the right care at the right time, avoiding unnecessary duplication of services and preventing medical errors. Accountable care organisations share the savings that accrue from coordinated endeavours for the Medicare program. All medicare shared savings programme participants must, however, move to a downside model after three years.

Downside shared savings: Downside shared savings includes the potential of gain in the share of an upside model but also share the downside risk of the excess costs of healthcare delivery between provider and payer/ purchaser, eg, health management organisations. Because providers are taking on greater risks with this model, the downside opportunity potential may, in fact, be larger in most cases than in an all-upside programme.

Capitation: In partial or full capitation healthcare payment model, a per member per month payment is settled, based on their age, race, sex, way of life, medical history and benefit design. Payment rates are tied to expected usage regardless of the actual patient visits. Like bundled payment models, healthcare providers have an incentive to help patients avoid high-cost procedures and tests in order to maximize their own compensations. Under partial/blended-capitation models, only certain types/categories of services are paid.

Global budget: Global budget is a fixed amount paid annually for all types of care. Providers can determine how fund is spent. Global budgets limit the level and the rate of increase of unexpected healthcare cost. Global budgets typically include a quality component as well.

Volume pricing: Volume pricing is based on the degree/depth/complexity of care.

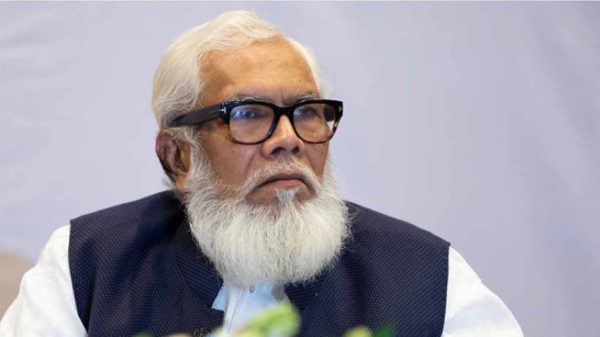

AM Zakir Hussain is a former director, Primary Health Care and Disease Control, former director of IEDCR, DGHS, former regional adviser of SEARO, WHO and former staff consultant, Asian Development Bank, Bangladesh.

Leave a Reply