Govt plans 7.6trn budget for FY24

Shawdesh desk:

The government will announce a Tk 7.6 trillion national budget for the 2023-24 fiscal year, with aims to curb inflation, reduce poverty, generate more revenues and reduce subsidies.

The preliminary budget estimate was approved at a meeting of the Council for the Coordination of Fiscal, Monetary, and Exchange Rate held last week, chaired by Finance Minister AHM Mustafa Kamal.

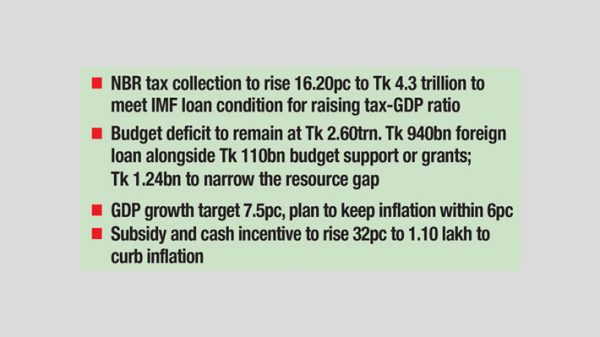

This proposed budget will be Tk 818.91 billion higher than the current fiscal year’s original budget of Tk 6.78 trillion and is anticipated to represent 15.20 percent of the estimated GDP. With increased spending in mind, the GDP growth target has been set at 7.5 percent.

To realize this ambitious spending plan, the government must collect Tk 5 trillion in revenues, which includes $4.3 trillion in NBR revenue. The remaining Tk 2.60 trillion budget deficit will be addressed through local and foreign loans and grants.

For the next fiscal year, the NBR tax, non-NBR tax, and non-tax revenue targets are being set 15 percent higher compared to the current fiscal’s original target of 4.33 trillion in order to comply with an IMF condition associated with its $4.7 billion loan.

The government must increase the tax-GDP ratio by 0.5 percentage points in FY24 to meet the IMF loan condition. Private estimates suggest that Bangladesh needs to collect an additional Tk 450 billion in revenues.

In light of this, the NBR has been assigned the responsibility of collecting more revenues. Finance ministry sources noted that the NBR chairman has already assured the government of achieving the target with the help of several reform initiatives.

The NBR tax collection target will rise by 16.20 percent to Tk 4.3 trillion from Tk 3.7 trillion in the current fiscal year.Additionally, Tk 200 billion is anticipated as non-NBR tax and Tk 500 billion as non-tax revenue.

This year, these two targets were Tk 180 billion and Tk 450 billion, respectively. Of the nearly Tk 2.60 trillion budget deficit, Tk 940 billion is expected to come from foreign loans taken under the Annual Development Programme (ADP), and Tk 110 billion as budget support or grants.

The domestic bank borrowing target is set at 1.24 trillion, and the remainder of domestic loans will come from savings certificate sales or other sources. Finance ministry officials mentioned that an initiative has been taken to reduce overall subsidies in accordance with IMF suggestions.

However, the government must contend with rising inflation. As a result, subsidies and cash incentives will increase by 32 percent to 1.10 lakh from Tk 827.45 billion.

The ADP size will grow by 6.80 percent to Tk 2.63 trillion, up from the current Tk 2.47 trillion. The government’s loan repayment burden will surge 27 percent in the 2023-24 fiscal year. The inflation target is set at 6 percent.

Leave a Reply