Govt should revise rules to safeguard banks: BAB chair

Shawdesh desk:

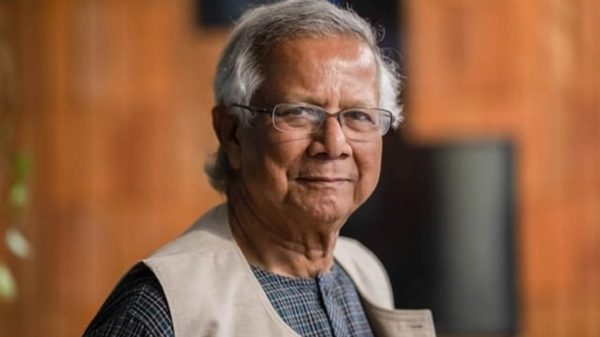

To safeguard the banking sector from exploitation in the future, the government, in collaboration with bank owners, should revise existing regulations that were crafted to disproportionately benefit a select group of corrupt individuals, said Abdul Hai Sarker, newly elected chairman of the Bangladesh Association of Banks.

In an interview with New Age on September 11, Abdul Hai laid out his views on the much-needed reforms in the country’s banking sector.

Abdul Hai, who is also the chairman of Dhaka Bank, stressed the urgent need for reforms in the sector to ensure that no individual or group can manipulate banking rules and regulations to their advantage, as had happened in the past.

He emphasised collaboration between the Bangladesh Bank and bank owners to address the sector’s challenges, improve governance and prevent future financial misconduct.

The BAB chairman started by calling for a comprehensive review of existing banking regulations, especially those that had been designed to benefit a small group of individuals unfairly.

He emphasised that these regulations must be revised to prevent future exploitation of the banking system.

Abdul Hai expressed his desire for the BAB to work closely with the central bank to ensure that reforms in the sector were effective and sustainable.

He suggested that any reform measures must be discussed with bank owners in advance to avoid unintended harm to the industry.

He emphasised the importance of consultation in making policies that were beneficial for all stakeholders.

Abdul Hai’s appointment as BAB chairman marked a significant change in leadership, as his predecessor, Nazrul Islam Mazumder, had held the position for an extended 17-year period.

Nazrul’s removal as chairman followed his removal from the board of Exim Bank by the Bangladesh Bank, which also led to his exit from the BAB.

This leadership change came shortly after the resignation of former prime minister Sheikh Hasina on August 5, amidst nationwide student protests.

Abdul Hai said that Nazrul was uncooperative and did not engage in discussions with the bankers, posing challenges to smooth operation of the banks.

With Nazrul gone, Abdul Hai is determined to make the BAB fully functional and accountable. He aims to establish a constructive working relationship between the banking sector and the government’s regulatory bodies.

‘As the new BAB chairman, we will create a bridge among the government regulatory bodies so that the government can know our challenges and we can know the government’s issues so that we can work together,’ he promised.

Abdul Hai emphasised the urgent need to address corruption and governance issues within the banking sector.

He stressed that those who had looted from the banking sector and had done enormous harm to the sector should not be allowed to continue their involvement with banks and called for stricter rules and regulations to prevent them from engaging in future misconduct.

He expressed frustration regarding the widespread narrative that portrayed all banks in a negative light.

According to Abdul Hai, such generalisation has caused significant damage to the sector, making it difficult for banks to regain public trust.

‘It’s true that some groups accumulated assets methodically by taking money from banks anonymously, but not all banks and owners were involved in these activities,’ Abdul Hai said.

He pointed out that these corrupt groups systematically withdrew large sums of money from banks, only to launder the funds abroad.

Abdul Hai pointed to weak governance as one of the main problems plaguing the banking sector.

He was particularly critical of the practice of appointing directors to government-owned banks based on political connections. This practice, he said, had enabled large-scale looting of public funds with the support of political parties.

Abdul Hai further noted that Bangladesh had too many banks for a country of its size and that many of these banks had been granted licences purely for political reasons, leading to an oversaturated market and inefficiencies, and increased opportunities for corruption.

A key issue raised by Abdul Hai was the handling of non-performing loans or NPLs.

He expressed concern over the legal loopholes that had allowed defaulting borrowers to avoid repaying their loans by securing repeated stay orders from courts. This, he said, has created a prime obstacle to recovering NPLs.

Abdul Hai called for legal reforms to prevent borrowers from abusing the judicial system to evade their obligations.

He voiced deep concern over the issue of money laundering, noting that recovering funds siphoned off abroad was incredibly complex due to differing legal frameworks in foreign countries.

He emphasised the importance of preventing future outflows.

‘The government must improve the standard of living in the country, develop the service sector and create a better business environment, which would encourage people to invest locally rather than seek to move their money abroad,’ Abdul Hai suggested.

He also stressed the need for a national commitment to fighting corruption and changing the mindset of citizens toward greater integrity and accountability.

‘Law and order must be improved to save the country from internal and external forces,’ he said, calling for stronger enforcement of anti-money laundering regulations.

Looking to the future, Abdul Hai expressed optimism about the banking sector’s potential, despite its current challenges.

He stressed that collaboration between the banking sector, government and regulatory bodies would be essential in ensuring the sector’s long-term stability so that it could continue contributing to the country’s economic growth.

‘The banking sector is a dedicated sector and the soul of finance to the economy, and we have many things to do in the sector,’ he noted.

He revealed that the BAB had already formed a committee to assess what steps could be taken to improve the banking industry, focusing on the development of policies that would benefit both banks and the broader economy.

Leave a Reply