Money legalisation provision retained

Shawdesh Desk:

The parliament passed the Finance Bill 2024 on Saturday while retaining in it the controversial provision of legalising undeclared wealth by paying a flat 15 per cent tax facing no question about its sources.

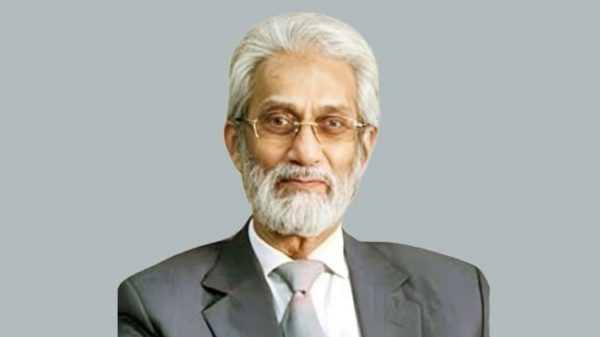

However, finance minister Abul Hassan Mahmood Ali had to withdraw a major proposal of imposing 30 per cent tax on individuals annually earning more than Tk 25 lakh facing opposition from the prime minister.

The diplomat-turned-finance-minister’s proposal for imposition of a 25 per cent duty on the import of cars by lawmakers was automatically cancelled because of legal complications regarding amendment of the Members of Parliament (Remuneration & Allowances) Order 1973, said finance ministry officials.

Parliament members have been enjoying the duty-free car import facilities for the past 36 years resulting in huge revenue losses for the government.

Besides, two proposals, one for cutting tax holiday facilities for investors in high-tech parks and special economic and export processing zones, and another for imposition of duty on the import of raw materials and capital machinery, were also dropped.

Prime minister Sheikh Hasina, while participating on the budget discussion, supported the legalisation of the undisclosed money provision saying that it was not black money.

She noted that as prices of everything increased, an owner of mere one katha land in Dhaka became the possessor of several crore of taka.

‘The generation of extra money could not be shown in the income tax,’ said the prime minister, adding that the scope would allow them to legalise the undisclosed gains and become regular taxpayers.

Sheikh Hasina said that former prime minister Khaleda Zia and former finance minister M Saiur Rahman availed such amnesty in the past.

Indicating to GM Quader, opposition leader in parliament, the prime minister further said that if former president HM Ershad legalised undisclosed assets needed to be checked.

Earlier, GM Quader in his speech criticised the controversial provision saying that the unethical scope would increase the generation of undisclosed money and encourage corruption.

The prime minister also opposed imposition of 30 per cent income tax on rich people saying that the payment of extra tax for the previous income year in the new financial year would not acceptable.

As a result, the highest tax rate remains at 25 per cent as before.

The tax free ceiling will be Tk 3,50,000, and for next Tk 1 lakh the tax is 5 per cent, for the next Tk 4 lakh the tax rate is 10 per cent, for the next Tk 5 lakh the tax rate is 15 per cent, for next Tk 5 lakh the rate is 20 per cent and for the rest it is 25 per cent.

The highest income tax slab rate of 30 per cent is likely to impose from FY26.

The proposal of imposition of 30 per cent tax on individuals making income of more Tk 25 lakh was aimed at checking growing income inequality, while the proposal for cutting tax holiday facilities for investors at high-tech parks and special economic and export processing zones was aimed at mobilising higher revenue.

The country’s tax-GDP is one of the lowest in the world.

The finance minister accepted 16 proposals on the Finance Bill, while 11 other amendment proposals were rejected by a voice vote.

As per the amendments, the companies have been relieved of paying surcharge for owning multiple vehicles.

However, the provision has been remained valid for individuals.

Income from the universal pension scheme will be tax free while individuals, companies and trusts have to pay 15 per cent gain tax.

The finance minister also retained imposition of a 15 per cent tax on capital gains exceeding Tk 50 lakh for beneficiaries in the share business despite strong opposition by the businesses. .

The finance minister while replying to the demands raised by the lawmakers said that the main aim of his budget proposal was to bring down inflation at 6.5 per cent in FY25.

Describing the background for proposing a contractionary budget, he said they might overcome the current downturn soon to go for 7 per cent GDP growth in the medium term.

The passage of the finance bill will allow the government to collect revenue against the projection of Tk 5.41 lakh crore and the projected GDPO growth of 6.75 per cent in FY25.

Of the overall revenue, the National Board of Revenue has been asked to collect Tk 4.80 lakh crore.

The finance minister also projected a 4.6 per cent budget deficit to be made up mostly by borrowing from banks.

The Annual Development Programme has been set at Tk 2.65 lakh crore in FY 25.

The appropriation bill is expected to be passed in Jatiya Sangsad today to authorise ministries and divisions to spend overall Tk 7.79 lakh crore in FY25, as projected by the finance minister while announcing the national budget.

Leave a Reply