IMF and World Bank: partners in backwardness

Guns and Butter host Bonnie Faulkner interviews Michael Hudson, a financial economist and historian. He is president of the Institute for the Study of Long-Term Economic Trend, a Wall Street financial analyst, and distinguished research professor of economics at the University of Missouri, Kansas City.

Bonnie Faulkner: In your seminal work form 1972, Super-Imperialism: The Economic Strategy of American Empire, you write: ‘The development lending of the World Bank has been dysfunctional from the outset.’ When was the World Bank set up and by whom?

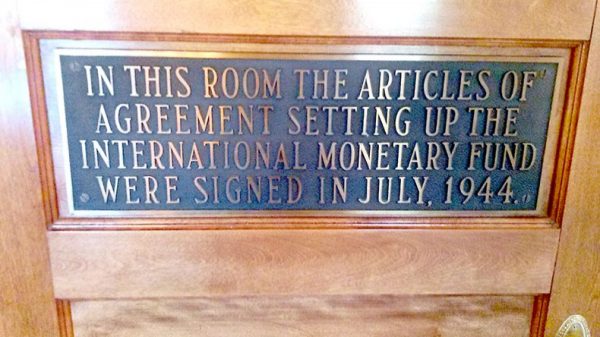

Michael Hudson: It was set up basically by the United States in 1944, along with its sister institution, the International Monetary Fund. Their purpose was to create an international order like a funnel to make other countries economically dependent on the United States. To make sure that no other country or group of countries — even all the rest of the world — could not dictate US policy. American diplomats insisted on the ability to veto any action by the World Bank or IMF. The aim of this veto power was to make sure that any policy was, in Donald Trump’s words, to put America first. ‘We’ve got to win and they’ve got to lose.’

The World Bank was set up from the outset as a branch of the military, of the Defence Department. John J McCloy (assistant secretary of war, 1941–45), was the first full-time president. He later became chairman of Chase Manhattan Bank (1953–60). McNamara was secretary of defence (1961–68), Paul Wolfowitz was deputy and under secretary of defence (1989–2005), and Robert Zoellick was deputy secretary of state. So I think you can look at the World Bank as the soft shoe of American diplomacy.

Bonnie Faulkner: What is the difference between the World Bank and the International Monetary Fund, the IMF? Is there a difference?

Michael Hudson: Yes, there is. The World Bank was supposed to make loans for what they call international development. ‘Development’ was their euphemism for dependency on US exports and finance. This dependency entailed agricultural backwardness — opposing land reform, family farming to produce domestic food crops, and also monetary backwardness in basing their monetary system on the dollar.

The World Bank was supposed to provide infrastructure loans that other countries would go into debt to pay American engineering firms, to build up their export sectors and their plantation sectors by public investment roads and port development for imports and exports. Essentially, the Bank financed long- investments in the foreign trade sector, in a way that was a natural continuation of European colonialism.

In 1941, for example, CLR James wrote an article on ‘Imperialism in Africa’ pointing out the fiasco of European railroad investment in Africa: ‘Railways must serve flourishing industrial areas, or densely populated agricultural regions, or they must open up new land along which a thriving population develops and provides the railways with traffic. Except in the mining regions of South Africa, all these conditions are absent. Yet railways were needed, for the benefit of European investors and heavy industry.’ That is why, James explained ‘only governments can afford to operate them,’ while being burdened with heavy interest obligations. What was ‘developed’ was Africa’s mining and plantation export sector, not its domestic economies. The World Bank followed this pattern of ‘development’ lending without apology.

The IMF was in charge of short-term foreign currency loans. Its aim was to prevent countries from imposing capital controls to protect their balance of payments. Many countries had a dual exchange rate: one for trade in goods and services, the other rate for capital movements. The function of the IMF and World Bank was essentially to make other countries borrow in dollars, not in their own currencies, and to make sure that if they could not pay their dollar-denominated debts, they had to impose austerity on the domestic economy — while subsidising their import and export sectors and protecting foreign investors, creditors and client oligarchies from loss.

The IMF developed a junk-economics model pretending that any country can pay any amount of debt to the creditors if it just impoverishes its labour enough. So when countries were unable to pay their debt service, the IMF tells them to raise their interest rates to bring on a depression — austerity — and break up the labour unions. That is euphemised as ‘rationalising labour markets.’ The rationalising is essentially to disable labour unions and the public sector. The aim — and effect — is to prevent countries from essentially following the line of development that had made the United States rich — by public subsidy and protection of domestic agriculture, public subsidy and protection of industry and an active government sector promoting a New Deal democracy. The IMF was essentially promoting and forcing other countries to balance their trade deficits by letting American and other investors buy control of their commanding heights, mainly their infrastructure monopolies, and to subsidise their capital flight.

Bonnie Faulkner: Now, Michael, when you began speaking about the IMF and monetary controls, you mentioned that there were two exchange rates of currency in countries. What were you referring to?

Michael Hudson: When I went to work on Wall Street in the ‘60s, I was balance-of-payments economist for Chase Manhattan, and we used the IMF’s monthly International Financial Statistics every month. At the top of each country’s statistics would be the exchange-rate figures. Many countries had two rates: one for goods and services, which was set normally by the market, and then a different exchange rate that was managed for capital movements. That was because countries were trying to prevent capital flight. They didn’t want their wealthy classes or foreign investors to make a run on their own currency – an ever-present threat in Latin America.

The IMF and the World Bank backed the cosmopolitan classes, the wealthy. Instead of letting countries control their capital outflows and prevent capital flight, the IMF’s job is to protect the richest one per cent and foreign investors from balance-of-payments problems. The World Bank and American diplomacy have steered them into a chronic currency crisis. The IMF enables its wealthy constituency to move their money out of the country without taking a foreign-exchange loss. It makes loans to support capital flight out of domestic currencies into the dollar or other hard currencies. The IMF calls this a ‘stabilisation’ programme. It is never effective in helping the debtor economy pay foreign debts out of growth. Instead, the IMF uses currency depreciation and sell-offs of public infrastructure and other assets to foreign investors after the flight capital has left and currency collapses. Wall Street speculators have sold the local currency short to make a killing, George-Soros style.

When the debtor-country currency collapses, the debts that these Latin American countries owe are in dollars, and now have to pay much more in their own currency to carry and pay off these debts. We’re talking about enormous penalty rates in domestic currency for these countries to pay foreign-currency debts — basically taking on to finance a non-development policy and to subsidise capital flight when that policy ‘fails’ to achieve its pretended objective of growth.

All hyperinflations of Latin America — Chile early on, like Germany after World War I — come from trying to pay foreign debts beyond the ability to be paid. Local currency is thrown onto the foreign-exchange market for dollars, lowering the exchange rate. That increases import prices, raising a price umbrella for domestic products.

A really functional and progressive international monetary fund that would try to help countries develop would say: ‘Okay, banks and we (the IMF) have made bad loans that the country can’t pay. And the World Bank has given it bad advice, distorting its domestic development to serve foreign customers rather than its own growth. So we’re going to write down the loans to the ability to be paid.’ That’s what happened in 1931, when the world finally stopped German reparations payments and Inter-Ally debts to the United States stemming from World War I.

Instead, the IMF says just the opposite: It acts to prevent any move by other countries to bring the debt volume within the ability to be paid. It uses debt leverage as a way to control the monetary lifeline of financially defeated debtor countries. So if they do something that US diplomats don’t approve of, it can pull the plug financially, encouraging a run on their currency if they act independently of the United States instead of falling in line. This control by the US financial system and its diplomacy has been built into the world system by the IMF and the World Bank claiming to be international instead of an expression of specifically US New Cold War nationalism.

Bonnie Faulkner: How do exchange rates contribute to capital flight?

Michael Hudson: It’s not the exchange rate that contributes. Suppose that you’re a millionaire, and you see that your country is unable to balance its trade under existing production patterns. The money that the government has under control is pesos, escudos, cruzeiros or some other currency, not dollars or euros. You see that your currency is going to go down relative to the dollar, so you want to get our money out of the country to preserve your purchasing power.

This has long been institutionalised. By 1990, for instance, Latin American countries had defaulted so much in the wake of the Mexico defaults in 1982 that I was hired by Scudder Stevens, to help start a Third World Bond Fund (called a ‘sovereign high-yield fund’). At the time, Argentina and Brazil were running such serious balance-of-payments deficits that they had to pay 45 per cent per year interest, in dollars, on their dollar debt. Mexico, was paying 22.5 per cent on its tesobonos.

Scudders’ salesmen went around to the United States and tried to sell shares in the proposed fund, but no Americans would buy it, despite the enormous yields. They sent their salesmen to Europe and got a similar reaction. They had lost their shirts on Third World bonds and couldn’t see how these countries could pay.

Merrill Lynch was the fund’s underwriter. Its office in Brazil and in Argentina proved much more successful in selling investments in Scudder’s these offshore funds established in the Dutch West Indies. It was an offshore fund, so Americans were not able to buy it. But Brazilian and Argentinian rich families close to the central bank and the president became the major buyers. We realised that they were buying these funds because they knew that their government was indeed going to pay their stipulated interest charges. In effect, the bonds were owed ultimately to themselves. So these Yankee dollar bonds were being bought by Brazilians and other Latin Americans as a vehicle to move their money out of their soft local currency (which was going down), to buy bonds denominated in hard dollars.

Bonnie Faulkner: If wealthy families from these countries bought these bonds denominated in dollars, knowing that they were going to be paid off, who was going to pay them off? The country that was going broke?

Michael Hudson: Well, countries don’t pay; the taxpayers pay, and in the end, labour pays. The IMF certainly doesn’t want to make its wealthy client oligarchies pay. It wants to squeeze ore economic surplus out of the labour force. So countries are told that the way they can afford to pay their enormously growing dollar-denominated debt is to lower wages even more.

Currency depreciation is an effective way to do this, because what is devalued is basically labour’s wages. Other elements of exports have a common world price: energy, raw materials, capital goods, and credit under the dollar-centred international monetary system that the IMF seeks to maintain as a financial strait jacket.

According to the IMF’s ideological models, there’s no limit to how far you can lower wages by enough to make labour competitive in producing exports. The IMF and World Bank thus use junk economics to pretend that the way to pay debts owed to the wealthiest creditors and investors is to lower wages and impose regressive excise taxes, to impose special taxes on necessities that labour needs, from food to energy and basic services supplied by public infrastructure.

Bonnie Faulkner: So you’re saying that labour ultimately has to pay off these junk bonds?

Michael Hudson: That is the basic aim of IMF. I discuss its fallacies in my Trade Development and Foreign Debt, which is the academic sister volume to Super Imperialism. These two books show that the World Bank and IMF were viciously anti-labour from the very outset, working with domestic elites whose fortunes are tied to and loyal to the United States.

Bonnie Faulkner: With regard to these junk bonds, who was it or what entity…

Michael Hudson: They weren’t junk bonds. They were called that because they were high-interest bonds, but they weren’t really junk because they actually were paid. Everybody thought they were junk because no American would have paid 45 per cent interest. Any country that really was self-reliant and was promoting its own economic interest would have said, ‘You banks and the IMF have made bad loans, and you’ve made them under false pretences — a trade theory that imposes austerity instead of leading to prosperity. We’re not going to pay.’ They would have seized the capital flight of their comprador elites and said that these dollar bonds were a rip-off by the corrupt ruling class.

The same thing happened in Greece a few years ago, when almost all of Greece’s foreign debt was owed to Greek millionaires holding their money in Switzerland. The details were published in the ‘Legarde List.’ But the IMF said, in effect that its loyalty was to the Greek millionaires who have their money in Switzerland. The IMF could have seized this money to pay off the bondholders. Instead, it made the Greek economy pay. It found that it was worth wrecking the Greek economy, forcing emigration and wiping out Greek industry so that French and German bond-holding banks would not have to take a loss. That is what makes the IMF so vicious an institution.

Bonnie Faulkner: So these loans to foreign countries that were regarded as junk bonds really weren’t junk, because they were going to be paid. What group was it that jacked up these interest rates to 45 per cent?

Michael Hudson: The market did. American banks, stock brokers and other investors looked at the balance of payments of these countries and could not see any reasonable way that they could pay their debts, so they were not going to buy their bonds. No country subject to democratic politics would have paid debts under these conditions. But the IMF, US and Eurozone diplomacy overrode democratic choice.

Investors didn’t believe that the IMF and the World Bank had such a strangle hold over Latin American, Asian, and African countries that they could make the countries act in the interest of the United States and the cosmopolitan finance capital, instead of in their own national interest. They didn’t believe that countries would commit financial suicide just to pay their wealthy one per cent.

They were wrong, of course. Countries were quite willing to commit economic suicide if their governments were dictatorships propped up by the United States. That’s why the CIA has assassination teams and actively supports these countries to prevent any party coming to power that would act in their national interest instead of in the interest of a world division of labour and production along the lines that the US planners want for the world. Under the banner of what they call a free market, you have the World Bank and the IMF engage in central planning of a distinctly anti-labour policy. Instead of calling them Third World bonds or junk bonds, you should call them anti-labour bonds, because they have become a lever to impose austerity throughout the world.

Bonnie Faulkner: Well, that makes a lot of sense, Michael, and answers a lot of the questions I’ve put together to ask you. What about Puerto Rico writing down debt? I thought such debts couldn’t be written down.

Michael Hudson: That’s what they all said, but the bonds were trading at about 45 cents on the dollar, the risk of their not being paid. The Wall Street Journal on June 17, reported that unsecured suppliers and creditors of Puerto Rico, would only get nine cents on the dollar. The secured bond holders would get maybe 65 cents on the dollar.

The terms are being written down because it’s obvious that Puerto Rico can’t pay, and that trying to do so is driving the population to move out of Puerto Rico to the United States. If you don’t want Puerto Ricans to act the same way Greeks did and leave Greece when their industry and economy was shut down, then you’re going to have to provide stability or else you’re going to have half of Puerto Rico living in Florida.

Bonnie Faulkner: Who wrote down the Puerto Rican debt?

Michael Hudson: A committee was appointed, and it calculated how much Puerto Rico can afford to pay out of its taxes. Puerto Rico is a US dependency, that is, an economic colony of the United States. It does not have domestic self-reliance. It’s the antithesis of democracy, so it’s never been in charge of its own economic policy and essentially has to do whatever the United States tells it to do. There was a reaction after the hurricane and insufficient US support to protect the island and the enormous waste and corruption involved in the US aid. The US response was simply: ‘We won you fair and square in the Spanish-American war and you’re an occupied country, and we’re going to keep you that way.’ Obviously this is causing a political resentment.

Bonnie Faulkner: You’ve already touched on this, but why has the World Bank traditionally been headed by a US secretary of defence?

Michael Hudson: Its job is to do in the financial sphere what, in the past, was done by military force. The purpose of a military conquest is to take control of foreign economies, to take control of their land and impose tribute. The genius of the World Bank was to recognise that it’s not necessary to occupy a country in order to impose tribute, or to take over its industry, agriculture and land. Instead of bullets, it uses financial manoeuvring. As long as other countries play an artificial economic game that US diplomacy can control, finance is able to achieve today what used to require bombing and loss of life by soldiers.

In this case the loss of life occurs in the debtor countries. Population growth shrinks, suicides go up. The World Bank engages in economic warfare that is just as destructive as military warfare. At the end of the Yeltsin period Russia’s president Putin said that American neoliberalism destroyed more of Russia’s population than did World War II. Such neoliberalism, which basically is the doctrine of American supremacy and foreign dependency, is the policy of the World Bank and IMF.

Bonnie Faulkner: Why has World Bank policy since its inception been to provide loans for countries to devote their land to export crops instead of giving priority to feeding themselves? And if this is the case, why do countries want these loans?

Michael Hudson: One constant of American foreign policy is to make other countries dependent on American grain exports and food exports. The aim is to buttress America’s agricultural trade surplus. So the first thing that the World Bank has done is not to make any domestic currency loans to help food producers. Its lending has steered client countries to produce tropical export crops, mainly plantation crops that cannot be grown in the United States. Focusing on export crops leads client countries to become dependent on American farmers — and political sanctions.

In the 1950s, right after the Chinese revolution, the United States tried to prevent China from succeeding by imposing grain export controls to starve China into submission by putting sanctions on exports. Canada was the country that broke these export controls and helped feed China.

The idea is that if you can make other countries export plantation crops, the oversupply will drive down prices for cocoa and other tropical products, and they won’t feed themselves. So instead of backing family farms like the American agricultural policy does, the World Bank backed plantation agriculture. In Chile, which has the highest natural supply of fertilizer in the world from its guano deposits, exports guano instead of using it domestically. It also has the most unequal land distribution, blocking it from growing its own grain or food crops. It’s completely dependent on the United States for this, and it pays by exporting copper, guano and other natural resources.

The idea is to create interdependency — one-sided dependency on the US economy. The United States has always aimed at being self-sufficient in its own essentials, so that no other country can pull the plug on our economy and say, ‘We’re going to starve you by not feeding you.’ Americans can feed themselves. Other countries can’t say, ‘We’re going to let you freeze in the dark by not sending you oil,’ because America’s independent in energy. But America can use the oil control to make other countries freeze in the dark, and it can starve other countries by food-export sanctions.

So the idea is to give the United States control of the key interconnections of other economies, without letting any country control something that is vital to the working of the American economy.

There’s a double standard here. The United States tells other countries: ‘Don’t do as we do. Do as we say.’ The only way it can enforce this is by interfering in the politics of these countries, as it has interfered in Latin America, always pushing the right wing. For instance, when Hillary’s State Department overthrew the Honduras reformer who wanted to undertake land reform and feed the Hondurans, she said: ‘This person has to go.’ That’s why there are so many Hondurans trying to get into the United States now, because they can’t live in their own country.

The effect of American coups is the same in Syria and Iraq. They force an exodus of people who no longer can make a living under the brutal dictatorships supported by the United States to enforce this international dependency system.

Bonnie Faulkner: Why are World Bank loans only in foreign currency, not in the domestic currency of the country to which it is lending?

Michael Hudson: That’s a good point. A basic principle should be to avoid borrowing in a foreign currency. A country can always pay the loans in its own currency, but there’s no way that it can print dollars or euros to pay loans denominated in these foreign currencies.

Making the dollar central forces other countries to interface with the US banking system. So if a country decides to go its own way, as Iran did in 1953 when it wanted to take over its oil from British Petroleum (or Anglo Iranian Oil, as it was called back then), the United States can interfere and overthrow it. The idea is to be able to use the banking system’s interconnections to stop payments from being made.

After America installed the Shah’s dictatorship, they were overthrown by Khomeini, and Iran had run up a US dollar debt under the Shah. It had plenty of dollars. I think Chase Manhattan was its paying agent. So when its quarterly or annual debt payment came due, Iran told Chase to draw on its accounts and pay the bondholders. But Chase took orders from the state department or the defence department, I don’t know which, and refused to pay. When the payment was not made, America and its allies claimed that Iran was in default. They demanded the entire debt to be paid, as per the agreement that the Shah’s puppet government had signed. America simply grabbed the deposits that Iran had in the United States. This is the money that was finally returned to Iran without interest under the agreement of 2016.

America was able to grab all of Iran’s foreign exchange just by the banks interfering. The CIA has bragged that it can do the same thing with Russia. If Russia does something that US diplomats don’t like, the US can use the SWIFT bank payment system to exclude Russia from it, so the Russian banks and the Russian people and industry won’t be able to make payments to each other.

This prompted Russia to create its own bank-transfer system, and is leading China, Russia, India and Pakistan to draft plans to de-dollarise.

Bonnie Faulkner: I was going to ask you, why would loans in a country’s domestic currency be preferable to the country taking out a loan in a foreign currency? I guess you’ve explained that if they took out a loan in a domestic currency, they would be able to repay it.

Michael Hudson: Yes.

Bonnie Faulkner: Whereas a loan in a foreign currency would cripple them.

Michael Hudson: Yes. You can’t create the money, especially if you’re running a balance of payments deficit and if US foreign policy forces you into deficit by having someone like George Soros make a run on your currency. Look at the Asia crisis in 1997. Wall Street funds bet against foreign currencies, driving them way down, and then used the money to pick up industry cheap in Korea and other Asian countries. This was also done to Russia’s ruble. The only country that avoided this was Malaysia, under Mohamed Mahathir, by using capital controls. Malaysia is an object lesson in how to prevent a currency flight.

But for Latin America and other countries, much of their foreign debt is held by their own ruling class. Even though it’s denominated in dollars, Americans don’t own most of this debt. It’s their own ruling class. The IMF and World Bank dictate tax policy to Latin America — to un-tax wealth and shift the burden onto labour. Client kleptocracies take their money and run, moving it abroad to hard currency areas such as the United States, or at least keeping it in dollars in offshore banking centres instead of reinvesting it to help the country catch up by becoming independent agriculturally, in energy, finance and other sectors.

Leave a Reply